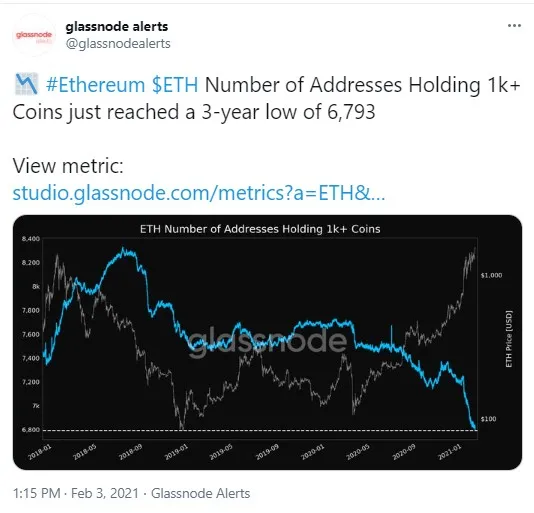

Glassnode analytics aggregator has shared that the number of wallets storing 1,000+ ETH has hit a major low, while the amount of addresses holding 1+ ETH has reached a one-month high.

ETH wallets face a one-month high and a three-month low

The new one-month high reached by owners of crypto wallets with 1+ ETH totals 1,135,845, according to data from Glassnode.

The amount of 1,000+ ETH wallets has dropped to a three-month low of 6,793.

It seems that mid-sized whales are simply gaining way more ETH, while retail investors are grabbing ETH as the coin has been trading near $1,470—reaching a new all-time high above $1,500.

Ethereum hits new ATH, ETH futures about to launch

On Feb. 2, the second-largest coin by market cap, ETH, finally broke out to reach a new all-time high of $1,567 per coin after spending about two weeks in a range between $1,300 and $1,400. This was after hitting the previous all-time high of $1,467.

Interest in ETH has been kept hot by the launch of the zero phase of Ethereum 2.0 in early December, with stakers continuing to lock their ETH in the deposit contract (with a total value locked close to $4.1 billion already).

The second major driver for investors to acquire ETH and expect its further rise is the upcoming launch of ETH-based futures on CME. This Chicago-based exchange caters to institutional investors.

Arman Shirinyan

Arman Shirinyan Caroline Amosun

Caroline Amosun Godfrey Benjamin

Godfrey Benjamin Tomiwabold Olajide

Tomiwabold Olajide