According to the latest study released by a group of blockchain analysts, the liquidity-providing activity of Uniswap v3 (UNI) users is not profitable "by design."

49.5% of liquidity providers suffer negative rewards

While it is widely perceived that liquidity provision on decentralized cryptocurrency exchanges (DEXes) with automated market-making engines (AMMs) is the most profitable passive income strategy in Web3.0, a recent study says that its status is far more complicated.

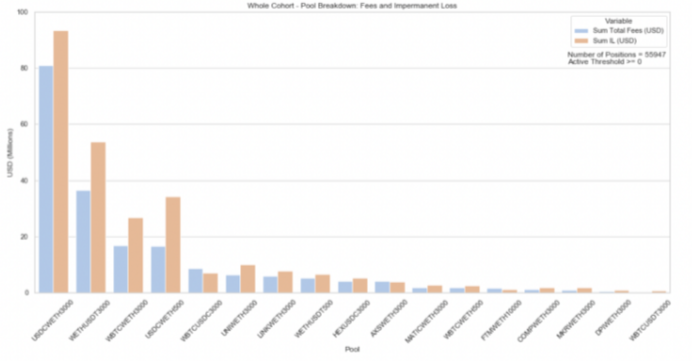

Amid 17,000 LP wallets analyzed, almost one-half (49.5%) demonstrated losses compared to simply holding assets. The impermanent loss dominated fee income for 80% of pools.

Since its v3 release, world-leading decentralized exchange Uniswap generated $199 million in liquidity rewards while the equivalent of $260 million disappeared due to an impermanent loss mechanism.

The authors of the research excluded from the analysis all pools with $10+ million in TVLs, all like-kind and stable-to-stable pools (e.g., renBTC/WBTC or USDC/DAI).

Which strategy is more profitable: active or passive?

The most painful losses were born by liquidity providers active in the following pools: MATIC/ETH (51%), COMP/ETH (59%), USDC/ETH (62%), COMP/ETH (59%) and MKR/ETH (74%).

The research team behind the analysis noticed zero correlation between the level of trading skills demonstrated by this or that liquidity provider and their net trading results:

Our core finding is that overall, and for almost all analyzed pools, impermanent loss surpasses the fees earned during this period. Importantly, this conclusion appears broadly applicable; we have collected evidence that suggests both inexperienced retail users and sophisticated professionals struggle to turn a profit under this model.

Also, there is no evidence that users who adjust their portfolios more frequently demonstrate more impressive results than "passive" liquidity providers.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov