Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The Ethereum Merge was the biggest and most fundamental update for Ethereum in the network's history. However, the decentralization of the network may have taken a hit, considering the suspicious holder distribution and the questionable nature of the biggest Ethereum investor on the market.

Lido's "decentralized model"

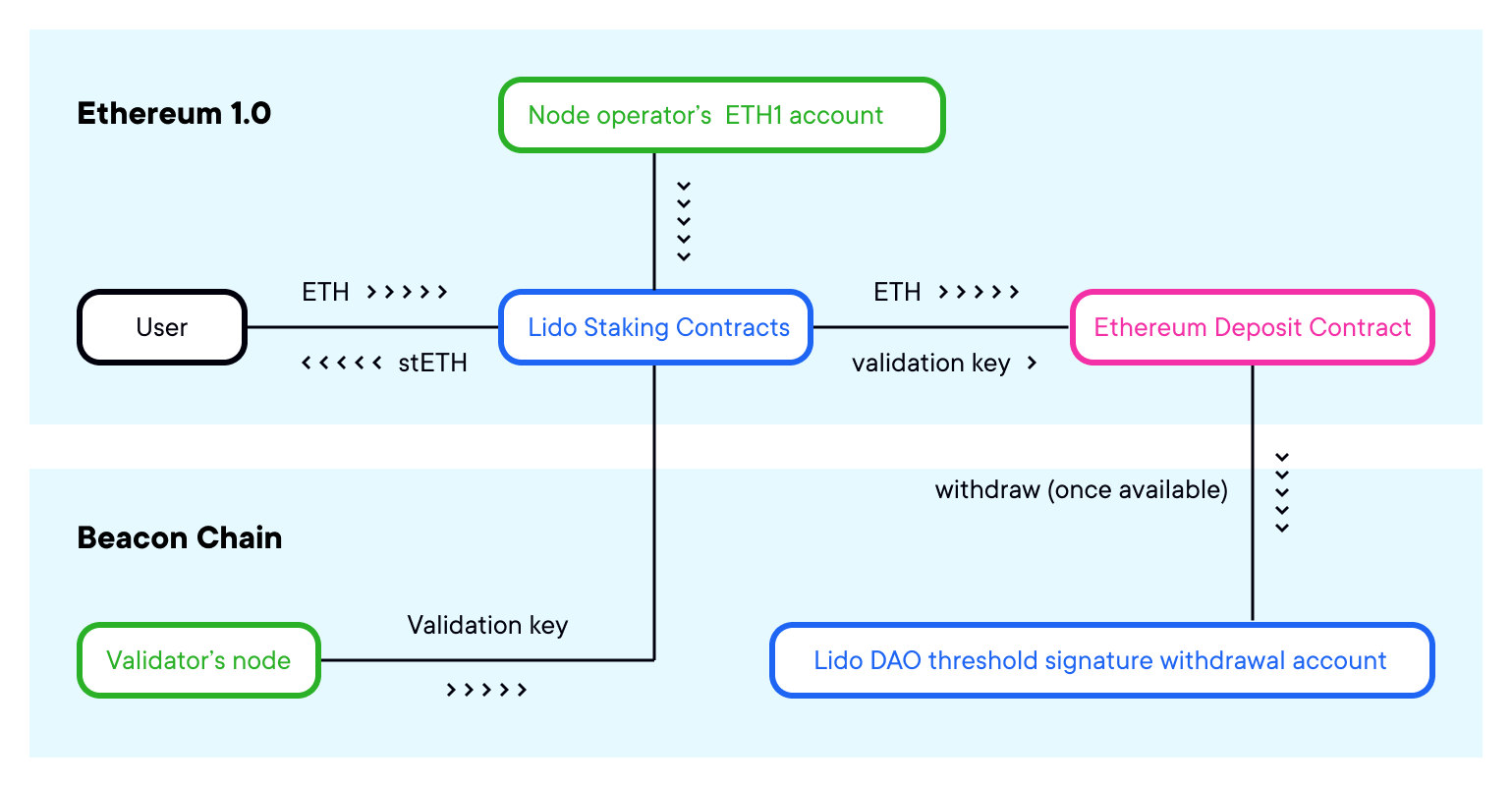

It is not a secret that Lido Finance is one of the biggest holders of "new" Ethereum that functions purely on the PoS model. But Lido itself has a certain financial model where the staking rewards received by the pool are not being sent out to delegators as they are.

Instead, Lido keeps all the rewards and sends stETH to delegators instead, which technically makes Lido a centralized ETH holder that can use it later without users' consent. With non-staked Ethereum being burned and rewards going to one entity, the decentralization of Ethereum is being questioned.

Paid out stETH tokens are not getting burned either, which is another factor that speaks in favor of centralization. Unfortunately, users will not be able to take control of their own ETH until staking contract withdrawals are allowed.

Lido's staked ETH causing turmoil on market

Back in June, the market was on the verge of a catastrophe after the staked ETH token started losing parity with spot Ethereum due to liquidity issues and the TerraUSD catastrophe. Despite having one of the deepest liquidity pools on the market, relatively moderate selling volume was enough to crash the value of the token issued by Lido.

Potentially, the crash of stETH can cause bigger turmoil on the market than the TerraUSD situation, considering the volume of tokens investors are holding right now.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov