Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Just as Bitcoin (BTC) goes through a stressful trading day, Michael Saylor has stepped into the spotlight — without saying much, yet enough. In a new post today, the Strategy CEO shared an AI-generated photo of himself at a chessboard, captioned simply: "Bitcoin is Chess."

What matters is that the timing of the post coincides with rising unease on the financial markets as all await fresh commentary from Federal Reserve Chair Jerome Powell.

Chess, after all, is about structure and strategy, not panic and prediction. Let's be fair, Saylor has mastered playing this long game, as Strategy, the company he chairs, holds one of the largest Bitcoin treasuries on the planet: 528,185 BTC valued at approximately $44.31 billion.

With an average purchase price of $67,458, the current market places the position in a healthy profit zone of roughly 24.35%.

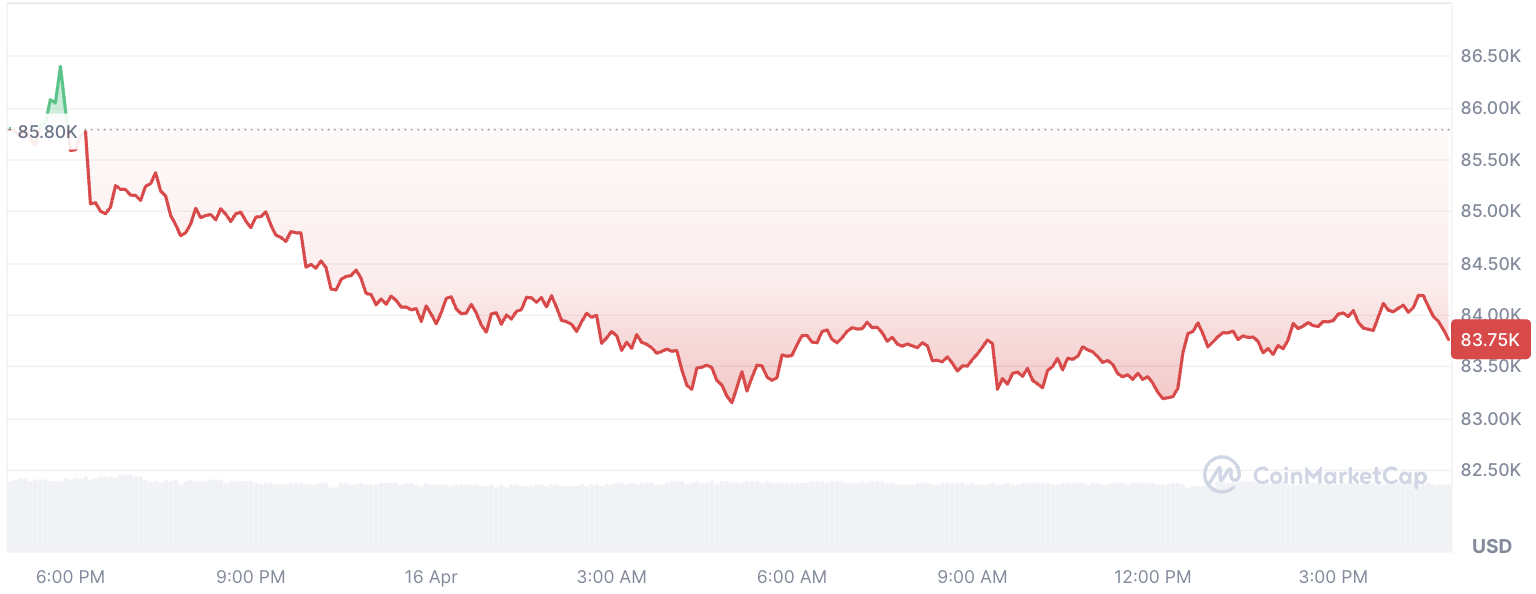

Today, however, it is not profits that dominate the conversation — it is anxiety. Bitcoin’s price chart for April 16 shows all the classic signs of nervous trading behavior. From the reset of the trading session, Bitcoin bounced erratically between $83,100 and $84,300, ultimately landing around $83,909.

The pattern reveals nervous sentiment: sharp reversals, short-lived rallies and no clear directional conviction. It is not a crash, not a breakout — just tension.

It is no coincidence that this atmosphere aligns with Powell’s anticipated commentary, expected to touch on interest rates, liquidity conditions and macro signals that could ripple through risk assets. In that frame, Bitcoin — as seen through Saylor’s lens — is less about timing the Fed and more about outlasting the noise.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov