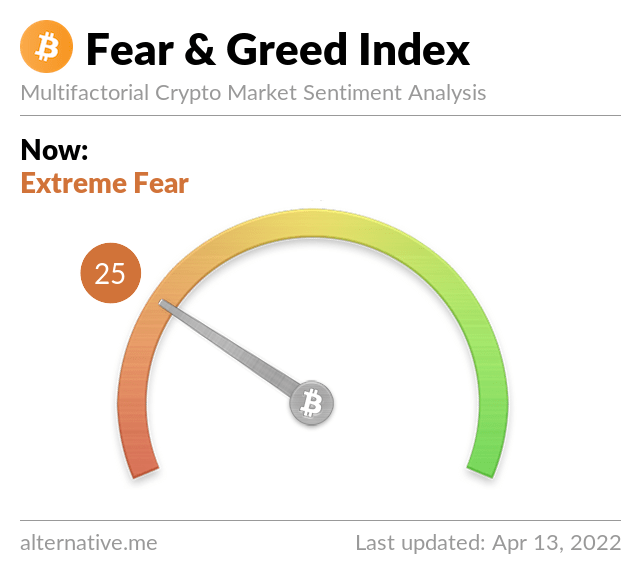

According to the Crypto Fear & Greed index, cryptocurrency market sentiment remains in "extreme fear" territory. It takes into account several factors, such as volatility, social media posts and trading volume, in order to determine how investors and traders feel about the current state of the market.

The index enters fear territory when it drops below 50. Most recently, it printed a score of 25, which indicates "extreme fear." The index gauges cryptocurrency traders' emotions on a daily basis.

Market sentiment has seen a significant shift within just two weeks. In late March, the index flashed "greed" for the first time in four months after the flagship cryptocurrency reached a new 2022 high of $48,234.

The recovery ended up being a flash in the pan. Earlier this week, Bitcoin plunged below $40,000 for the first time since March 16 amid worries that the U.S. Federal Reserve has adopted an even more aggressive monetary tightening policy to deal with high inflation.

There is a group of contrarian traders and investors who tend to buy fear, defying overall market sentiment. Legendary investor Warren Buffett once said that one should be greedy when others are fearful. However, the "buy low, sell high" mentality does not always work out as planned in crypto. Dip-buying can often backfire since traders may simply end up catching a falling knife.

No matter how low Bitcoin goes, one should keep in mind that it could always go lower in a "max pain" scenario. There have been several occasions when the index plunged below 10 after brutal selloffs.

Alternatively, there could be a king and painful period of consolidation. As reported by U.Today, legendary trader Peter Brandt predicted that Bitcoin could see years of range-bound trading.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov