Ethereum (ETH) supply on centralized exchanges nosedives to 2018 levels. Where are Ethereum (ETH) holders transferring their coins?

Selling pressure on Ethereum (ETH) reduced

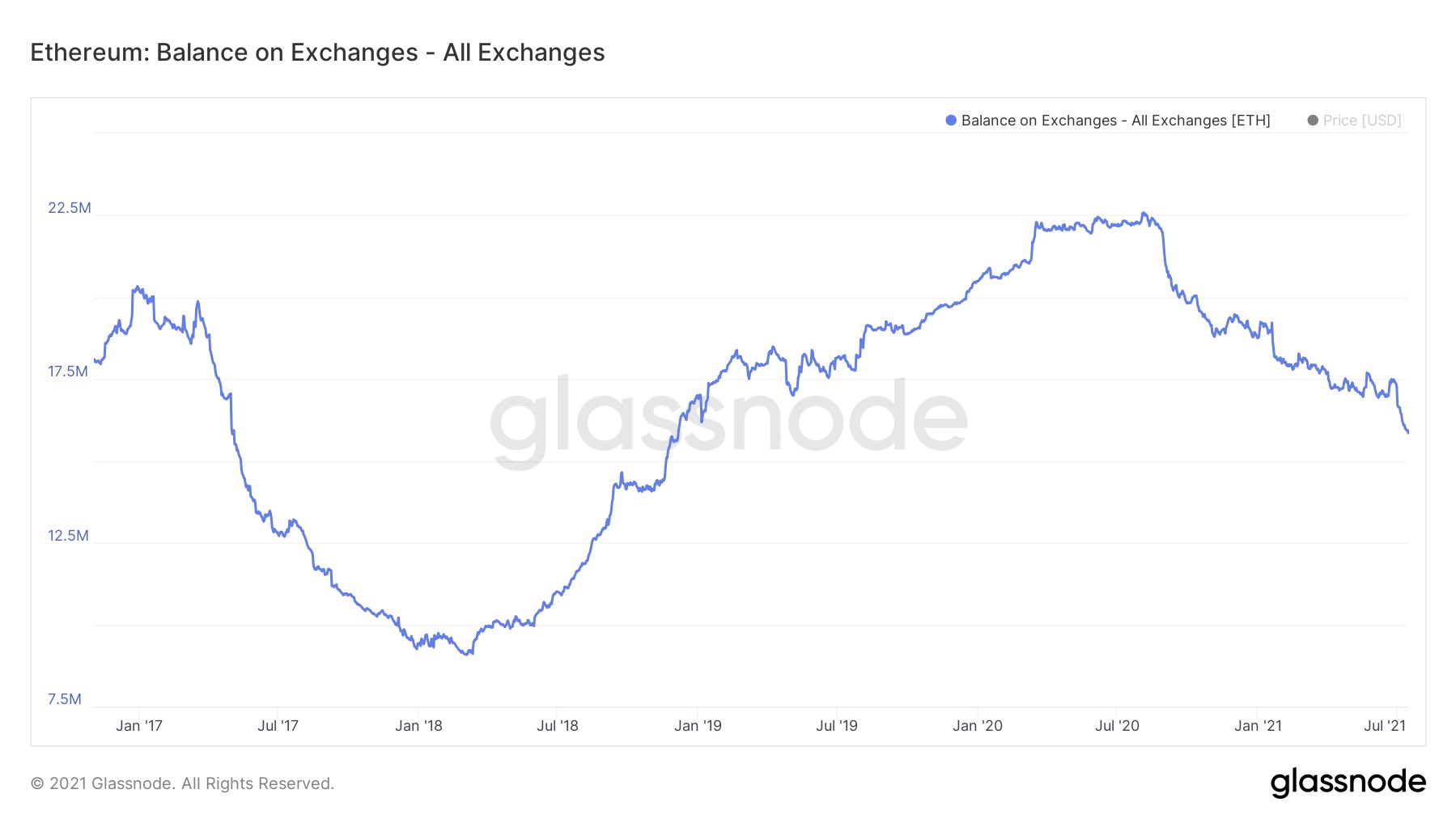

According to data by leading on-chain data vendor Glassnode, Ethereum (ETH) holders are aggressively withdrawing their coins from centralized exchanges.

This trend has been valid for 12 months in a row. For the first time, the Ethereum (ETH) balance on exchanges started decreasing in July 2020. Back then, Ethereum (ETH) was worth $200-$300.

The uptrend in Ethereum's (ETH) quantity on centralized exchanges was dominant between March 2018 and March 2020. The net number of Ethers on exchanges stabilized after Black Friday in Crypto.

As a result of this prolonged withdrawal impulse, the aggregated quantity of Ethereums (ETH) stored in exchanges' wallets is close to levels unseen since late Q4, 2018.

Holders take a breath before EIP-1559

At the same time, the Ethereum (ETH) supply locked in smart contracts is rocketing. For the first time in Ethereum's (ETH) six-year mainnet history, this indicator has broken above 26 percent.

For the first time, this indicator started to boom during the DeFi Craze of Q2-Q3, 2020. Also, it is witnessing an upsurge since January 2021.

Both processes are catalyzed by the upcoming EIP-1559 activation. Due to this release, Ether (ETH) is going to become a deflationary asset.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov