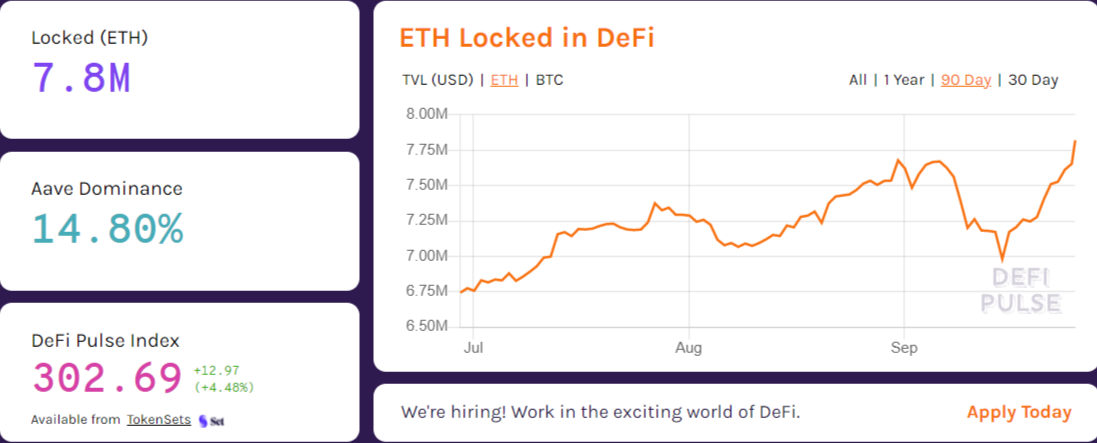

After a massive plunge in TVL, a decentralized finance ecosystem has recovered to observe some breathtaking metrics.

7,830,000 Ethers locked in DeFi

The net number of Ethers locked in various decentralized finance protocols spiked 12% in the past ten days. On Sept. 15, 2021, this indicator bottomed at a two-month low of about 6.95 million Ethers.

As displayed by mainstream decentralized finances segment tracker DeFi Pulse, the total quantity of Ethers in all indexed protocols nets 7.8 million Ethers.

Aave Finance (AAVE), Compound Finance (COMP), Instadapp, Uniswap (UNI), Curve Finance (CRV) are the most popular protocols in terms of TVL.

The five leading DeFis are responsible for almost 6.9 million Ethers, or 85% of net TVL, tracked by DeFi Pulse.

Yearn.Finance (YFI), Rari Capital (RGT) are on fire

In the last 24 hours, two DeFi protocols, Yearn.Finance (YFI) and Rari Capital (RGT), registered double-digit gains.

At the same time, the Ethereum 2.0 deposit contract targets almost the same numbers. As of Sept. 25, 2021, it has amassed 7.77 million Ethers.

Amid the current Ethereum (ETH) price dip, this massive amount of value is equal to $22.7 billion. To provide context, this sum can be compared to the market capitalization of Telenor, Credit Suisse, Suzuki and Warner Music Group.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin