Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

El Salvador's bold venture into the world of Bitcoin (BTC) has been making headlines ever since its announcement. Aiming to strengthen this decision and contribute to the nation's wealth, the Salvadoran government embarked on an aggressive investment strategy that has recently started showing promising results.

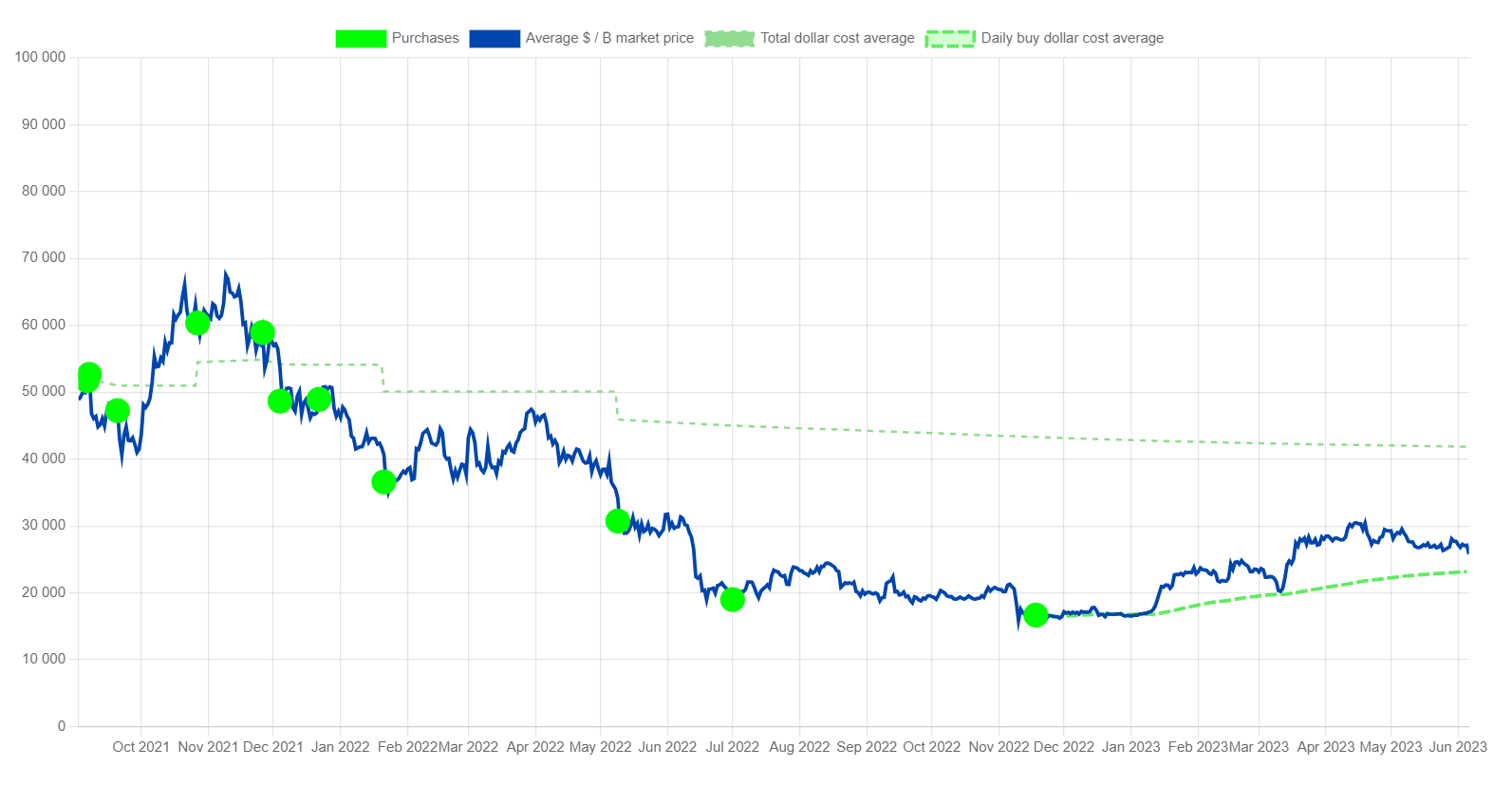

In November, President Nayib Bukele announced a new approach. Instead of making large, one-off purchases of Bitcoin, El Salvador would now buy one Bitcoin per day, a strategy aimed at dollar-cost averaging into the market. This approach of consistently buying the same amount over time, regardless of price fluctuations, is often used to mitigate the risk of investing a large amount in a single transaction at an unfavorable price.

Fast forward to today, and the results are becoming visible. El Salvador's Bitcoin portfolio is nearing its breakeven point. This is a significant milestone considering the volatility of the crypto market, which has seen Bitcoin's price oscillate wildly since El Salvador's initial adoption.

The country's approach highlights a key aspect of investment strategy: patience. By consistently investing and holding onto their Bitcoin, El Salvador is nearing the point where the current value of its portfolio will match the total investment made.

The breakeven point's proximity signifies not just the potential success of El Salvador's Bitcoin strategy but also the resilience of the cryptocurrency. Despite market downturns, the sustained strategy of the Salvadoran government, paired with the underlying strength of Bitcoin, has made it possible for the country to edge closer to recouping its investment.

The impact of this approach extends beyond the borders of El Salvador. Other nations are closely watching the Bitcoin experiment unfold. As El Salvador's Bitcoin portfolio approaches breakeven, it could serve as a model for other countries considering a similar path.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin