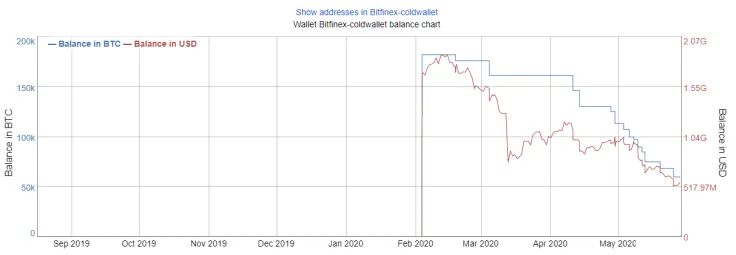

According to data provided by BitInfoCharts, large amounts of Bitcoin continue to exit the Bitfinex exchange, months after the monumental crash that happened on March 12.

The publicly known cold storage of one of the biggest cryptocurrency trading platforms holds just 60,000 BTC, which represents a dramatic 67 percent drop since February.

The withdrawing spree

After ‘Black Thursday’, users started to withdraw funds from exchanges en masse, with Bitfinex and BitMEX topping the loserboard.

Coins started pouring out of these trading platforms en masse after March 12 and, since then, this trend has continued for the past two months.

For many analysts, this was perceived as a bullish indicator since investors are less likely to resort to panic selling when BTC makes tumultuous price moves. There is also a theory that more security-conscious users now want to take responsibility for holding their funds instead of relying on third-party actors.

Still, some other major exchanges in the likes of Binance and Bitstamp remained practically unscathed, according to CoinMetrics.

Ether instead of Bitcoin

Another notable trend is that Bitfinex has simultaneously managed to significantly increase its Ethereum holdings while orange coins have been fleeing from the exchange.

Earlier this month, Bitfinex’s Ethereum holdings surpassed the entire decentralized finance (DeFi) sector.

There is now more $ETH locked in @bitfinex than in the whole of #DeFi (source: @glassnode)

— Elias Simos (@eliasimos) May 12, 2020

Since mid-March, the balance of ETH on Bitfinex has increased from ~2.5M to ~4M ETH. Over the same period, ~3B Tether has printed on the Ethereum chain.

Is Tether eating Ethereum…? pic.twitter.com/tJuKikcn9R

This is a world of difference from April 26 when users started to withdraw Ether from the exchange in droves, hot on the heels of the $850 mln Tether cover-up.

Gassnode’s analyst Elias Simons suggested that Bitfinex could be hoarding ETH to play a major role in Ethereum 2.0 staking.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin