The crypto market continues to break one bottom after another. Scam token launches from presidents, the failure of Bitcoin (BTC) as an asset with a six-digit price figure and now the first major outflows from cryptocurrency-oriented investment products.

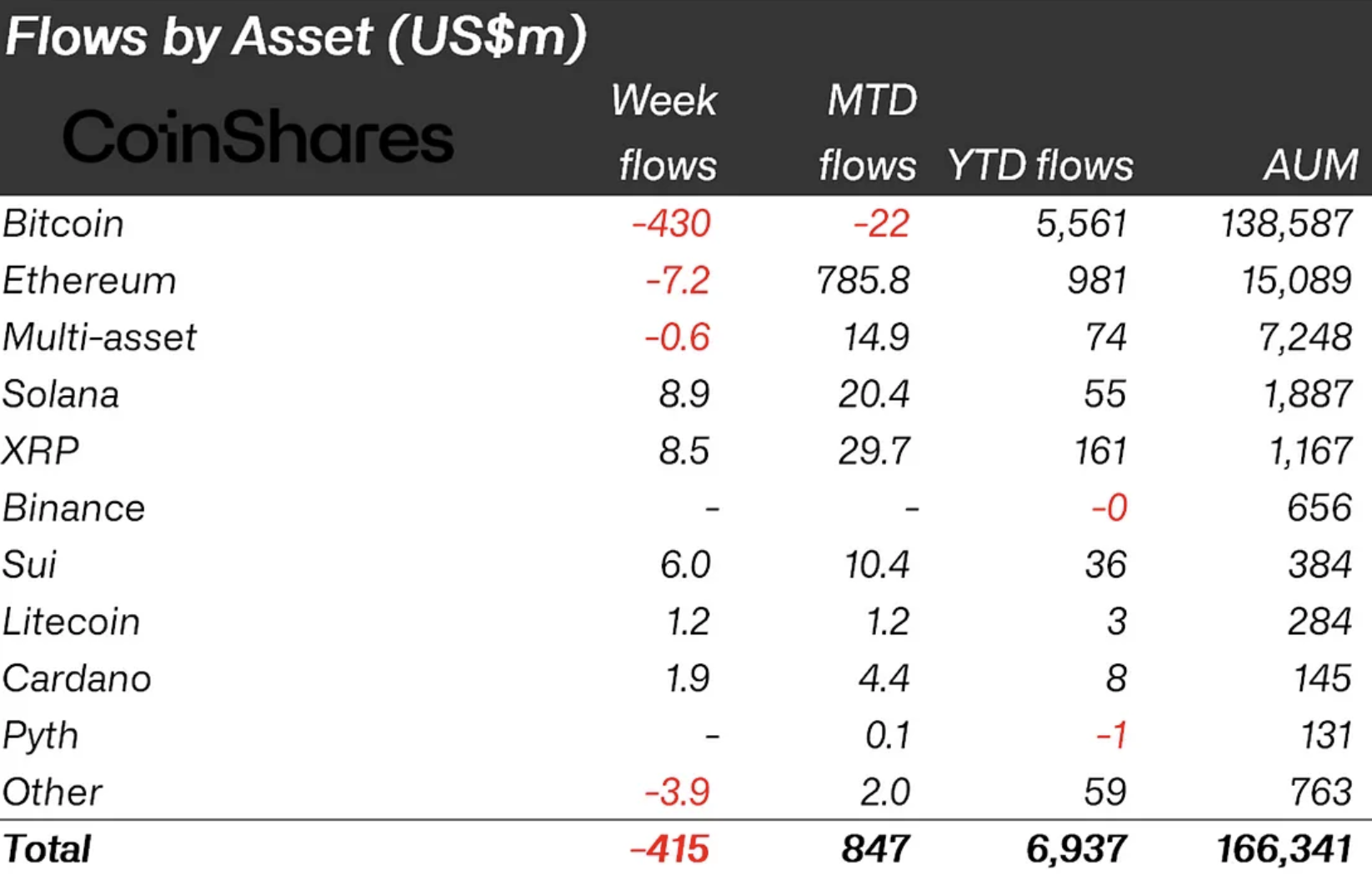

After 19 weeks of inflows into crypto investment products such as Bitcoin ETFs, which resulted in nearly $30 billion flowing into the market, last week saw a cumulative outflow of $415 million.

The most affected were those exchange-traded funds focused on the main cryptocurrency, with $430 million in outflows. As a result, BTC ETFs now have $22 million in the red since the beginning of February. It has been a while since that happened after all the positivity with inflows.

The second largest cryptocurrency, Ethereum (ETH), and investment products focused on it saw outflows of $7.2 million, according to CoinShares.

Other altcoins showed inflows at the same time. Now the focus of investors is on such crypto instruments as XRP, Solana (SOL), Cardano (ADA) and Litecoin (LTC).

These are not exchange-traded funds, but products, as they have not yet received full-fledged solutions. The inflows into them amounted to $8.5 million, $8.9 million, $1.9 million and $1.2 million, respectively.

However, even here we can state outflows at a rate of 30% on average in comparison with the week before. In other words, investors continue to buy rather than sell them, but with less enthusiasm.

It will be interesting to see how things change in the coming days - especially since Bitcoin has separated itself from the S&P 500 in its behavior today. It is possible that this will play into the hands of the main cryptocurrency.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin