As reported by Glassnode in recent tweets, both current Bitcoin miners and BTC holders who have owned their crypto since 2016 are sitting on their BTC stashes and are unwilling to sell them.

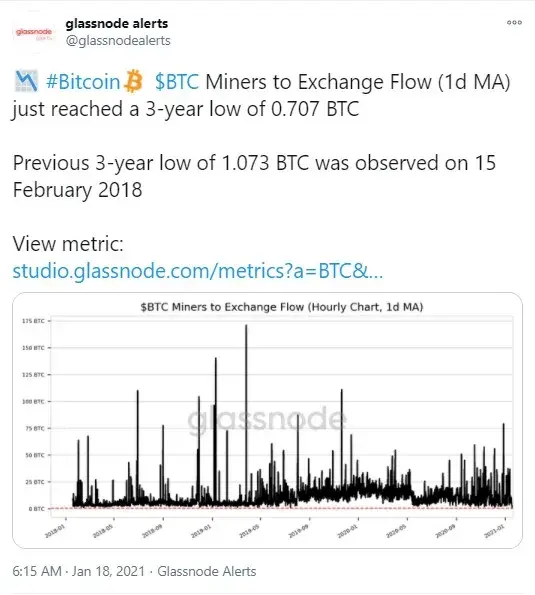

Miner to exchange flow hits three-year low

Glassnode has reported that the amount of the flagship cryptocurrency sent by crypto miners to digital exchanges is still in decline and has reached a three-year low. The figure totals 0.707 BTC.

The previous low over the same period of time was observed two years ago, on February 15, 2018.

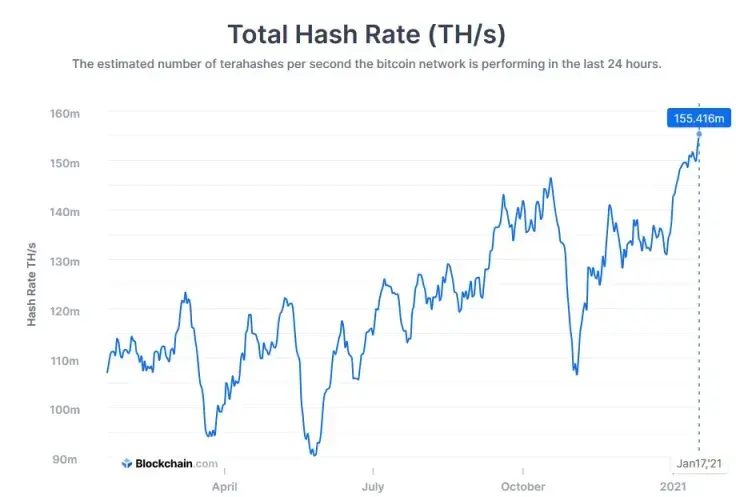

Meanwhile, BTC hash rate is at an all-time high of 155.416 million TH/s as of Jan. 17, which signifies that the Bitcoin network is as strong as ever.

The recent rise of Bitcoin to its all-time high above $42,000 has driven new miners into the network.

Active BTC supply over last 5y-7y hits 5-year low

As per another tweet published by Glassnode, crypto investors who got ahold of their Bitcoin back in 2016 are not in a rush to get rid of it on exchanges or otherwise.

The active 5-year-7-year (1-day MA) BTC supply has dropped to a five-year low and now constitutes 745,984.998 BTC.

It looks like the value of this metric has been dropping steadily as the previous five-year low was 746,042.543 BTC—observed two days ago.

Reasons for the Bitcoin rally from financial expert Nic Carter

A partner at Castle Island Ventures, renowned financial expert Nic Carter, has published an article in which he lays out the most likely reasons behind the current Bitcoin rally and the cryptocurrency's continued support.

Among the reasons, he mentioned strong monetary stimulus policy conducted by global central banks, the inflow of institutional funds into Bitcoin and OCC permission for banks to hold their customers' private key for crypto.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin