JPMorgan Chase analyst Nikolaos Panigirtzoglou is convinced that Bitcoin could face a more dramatic correction if it fails to reclaim the make-it-or-break-it $40,000 level.

A failure to continue its rally could make trend-following investors call it quits, the analyst assumes.

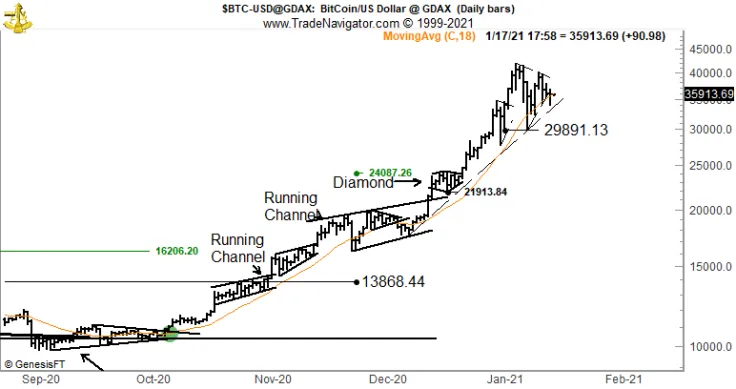

As reported by U.Today, the cryptocurrency once soared above the aforementioned level on Jan. 14 after its biggest drop since March. This, however, didn’t trigger more buying pressure, and Bitcoin swiftly pared some of its gains. At press time, Bitcoin is trading at just above $35,000.

Commodity trader Peter Brandt is seemingly on the same page with JPMorgan, tweeting that the orange coin needed to “blast off” from there in order to avert a “more complicated” correction.

Keep an eye on Grayscale’s inflows

While some go as far as following celestial bodies to predict future Bitcoin moves, JPMorgan recommends keeping tabs on the inflows of leading cryptocurrency asset manager Grayscale. The bank’s strategists have estimated that they would need to stay above $100 million per day for Bitcoin’s rally not to lose its steam:

The flow into the Grayscale Bitcoin Trust would likely need to sustain its $100 million per day pace over the coming days and weeks for such a breakout to occur.

The leading U.S. bank believes that Grayscale helped Bitcoin to finally conquer $20,000 in early December, and it remains to be seen whether it will be the case with $40,000.

Another day, another record for Grayscale

According to Grayscale’s newly appointed CEO, Michael Sonnenshine, the asset manager raked in a record-breaking $700 million on Jan. 15 alone, significantly exceeding the JPMorgan target.

Its family of investment products attracted $3.3 billion worth of inflows in the fourth quarter.

The Grayscale Bitcoin Trust alone currently has $22.901 billion, and Sonnenshine says that there has been “a push for diversification” into altcoins among their clients

Certainly most investors' first taste of #crypto is #bitcoin, but have increasingly been seeing a push for diversification within the asset class from our institutions.

Advertisement

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov