Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

If history is any indication, the biggest cryptocurrency in terms of market capitalization, Bitcoin, may be bracing for a volatility spike and a lurch lower. In recent months, Bitcoin — which is well known for its volatility — has been relatively calm, oscillating in a rather narrow range around the $20,000 level after it touched lows of $17,600 in June.

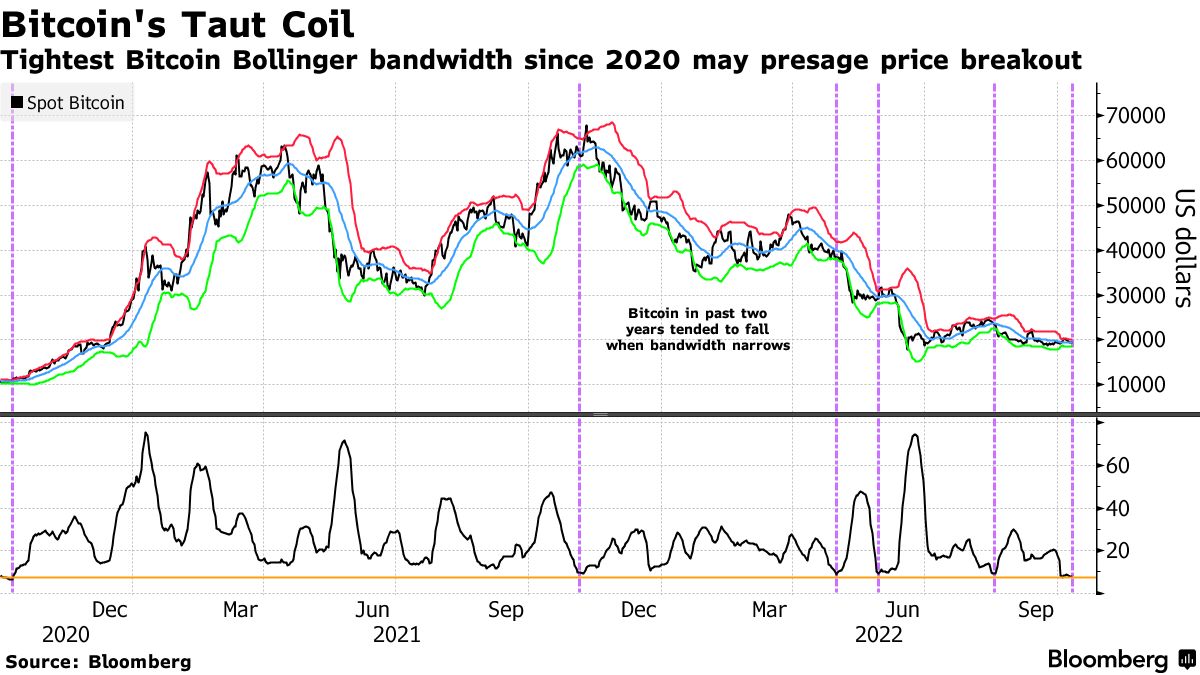

According to Bloomberg analysis, the Bollinger Bandwidth, a potentially ominous signal, has now shrunk to its narrowest since 2020. The bandwidth in a Bollinger analysis, a common method of determining volatility, is the distance between the upper and lower bands.

As a result, some analysts see the narrow Bollinger Bandwidth as a sign that Bitcoin price volatility might spike and, thus, reduce its price.

A nearly 60% decline in the price of Bitcoin this year resulted from a global wave of monetary tightening to combat inflation. Since touching a $3 trillion peak in November 2021, cryptocurrencies have lost around $2 trillion, which has forced regulators to tighten control.

Additionally, the world markets are anticipating Thursday's U.S. inflation data. A strong result might fuel expectations of additional Federal Reserve interest-rate increases, shaking up a variety of assets, while a significant slowdown might have the opposite effect. Market observers anticipate Bitcoin being largely macro-driven in the near term.

Bitcoin must sustain above $19K

#Bitcoin | Losing the $19,000 support level can spell trouble! https://t.co/U81bjTS2bE?from=article-links

— Ali (@ali_charts) October 10, 2022

Crypto analyst Ali claims that Bitcoin needs to hold the $19K support level to avoid a sharp decline. At this price level, 1.3 million addresses have purchased more than 680,000 BTC, and on-chain data indicates that there is little-to-no support below it.

At the time of publication, BTC was trading marginally down at $19,334.

On-chain analytics firm Glassnode reports that the on-chain cost basis for Bitcoin short-term holders has crossed below that of long-term holders. This might imply that buyers of BTC over the last five months now have a superior cost basis to those who "HODLed" through all the volatility of the 2020–2022 cycle.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov