Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

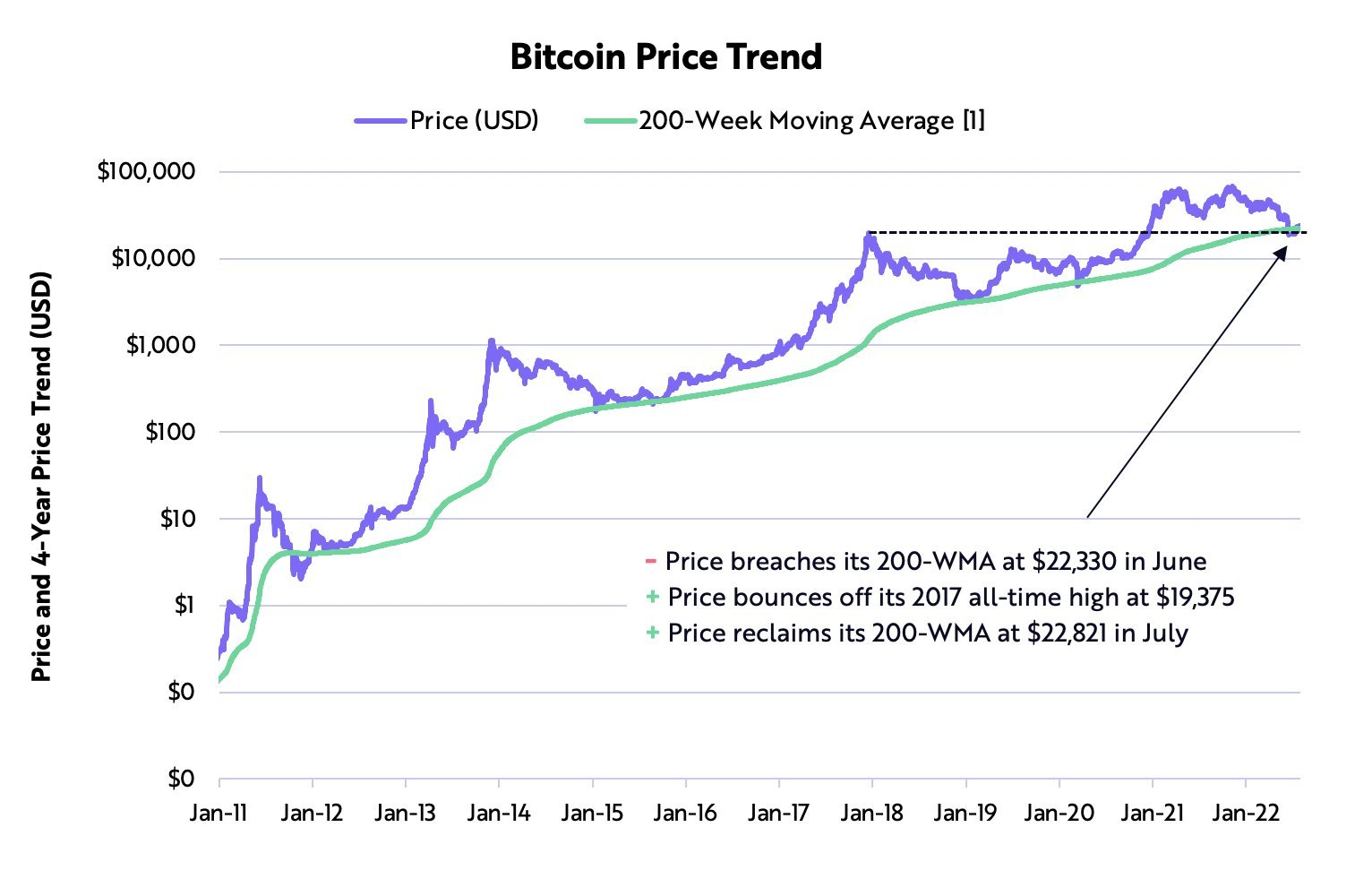

In a recent Twitter thread, Yassine Elmandjra, analyst at Cathie Wood's Ark Invest Management, noted that Bitcoin, the largest cryptocurrency, has managed to reclaim the 200-week moving average.

This has only happened seven times in history. On average, Bitcoin would soar by 240% after each such event, according to Ark Invest's calculations.

Elmandjra has noted that the price of the flagship cryptocurrency is now sitting below its cost basis. This also happened during the worst days of the pandemic-driven market sell-off in March 2020 after the price of Bitcoin infamously halved within 24 hours.

Notably, Elmandjra believes that risk-on sentiment is making a comeback in both U.S. equities and crypto. Since there is a significant correlation between the two asset classes, the analyst views this as a positive sign for Bitcoin. As reported by U.Today, July ended up being Bitcoin's best month of 2022 (so far). The cryptocurrency rebounded sharply after logging its worst quarter in more than 10 years. It is worth mentioning that U.S. stocks also recorded their best month since 2020.

Uncertainty remains

That said, Elmandjra is not rulings out that Bitcoin may end up going lower if this bear market replicates the trajectory of the 2018 bear winter. Back then, the top cryptocurrency lost well over 80% of its value within a year.

Bitcoin and cryptocurrency remain in U.S. Federal Reserve Chair Jerome Powell’s grip. As Elmandjra believes, uncertainty surrounding the central bank's policy is still the main headwind for the Bitcoin price.

At press time, the largest cryptocurrency is changing hands at $23,305.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin