Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

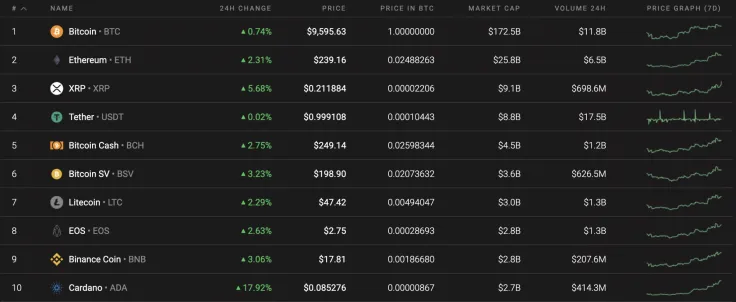

The last weekend of May is finishing on a positive note for the cryptocurrency market. All of the coins from the Top 10 list are in the green, with Cardano (ADA) remaining the top gainer, having rocketed up by almost 18% in just the last 24 hours.

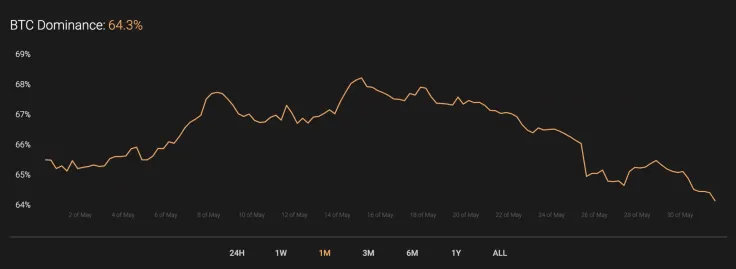

With the altcoins maintaining their growth, the dominance rate for Bitcoin (BTC) has gone down slightly over the last month and is currently sitting at 64.3%. This is compared to BTC's dominance rate of 65.55%, which was at the beginning of the month.

Below is the relevant data for Bitcoin (BTC) and how it is looking today:

-

Name: Bitcoin

Advertisement -

Ticker: BTC

-

Market Cap: $176,070,570,298

-

Price: $9,574.03

Advertisement -

Volume (24H): $29,617,337,585

-

Change (24H): 0.74%

BTC/USD: Is Bitcoin Ready to Break the $10,000 Mark This Time?

Bitcoin (BTC) is about to finish May with a growth of 25% since the beginning of the month. In terms of weekly analysis, the chief cryptocurrency has added 4.73% to its value.

Looking at the hourly chart, Bitcoin (BTC) has shown little activity largely because the weekends, which act as days-off, usually result in a drop in price. Such a statement is supported by the declining trading volume. Even though the bullish trend is not yet finished, traders might expect a correction during the beginning of the new week to its nearest support level at $9,400.

According to the daily chart, Bitcoin (BTC) might retest the $8,500 level one more time before another attempt to conquer the $10,000 mark and fix above it. There is a high probability that such a scenario may come true as the buying trading volume continues to decline. There are also lowering heights, which confirms the weakness of the bulls. All in all, one needs to pay close attention to the $8,500 level.

Looking at the weekly time frame, the last candle is about to close below the previous one, which shows the lack of strength by the bulls to push the price higher. What is more, there was no consolidation period that allowed Bitcoin (BTC) to gain traction and start a bullish trend as it did in Spring 2019.

In this case, one is unlikely to see a V-shape recovery. To sum it up, there is high probability of a sharp dump to the nearest vital area in June 2020, which is between $7,400-$7,500.

At press time, Bitcoin was trading at $9,582.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov