In the recent CoinShares' report, Bitcoin (BTC) and XRP have shown consistent appeal to traditional investors, marked by substantial inflows in exchange-traded products (ETP) oriented around these popular cryptocurrencies in the past week.

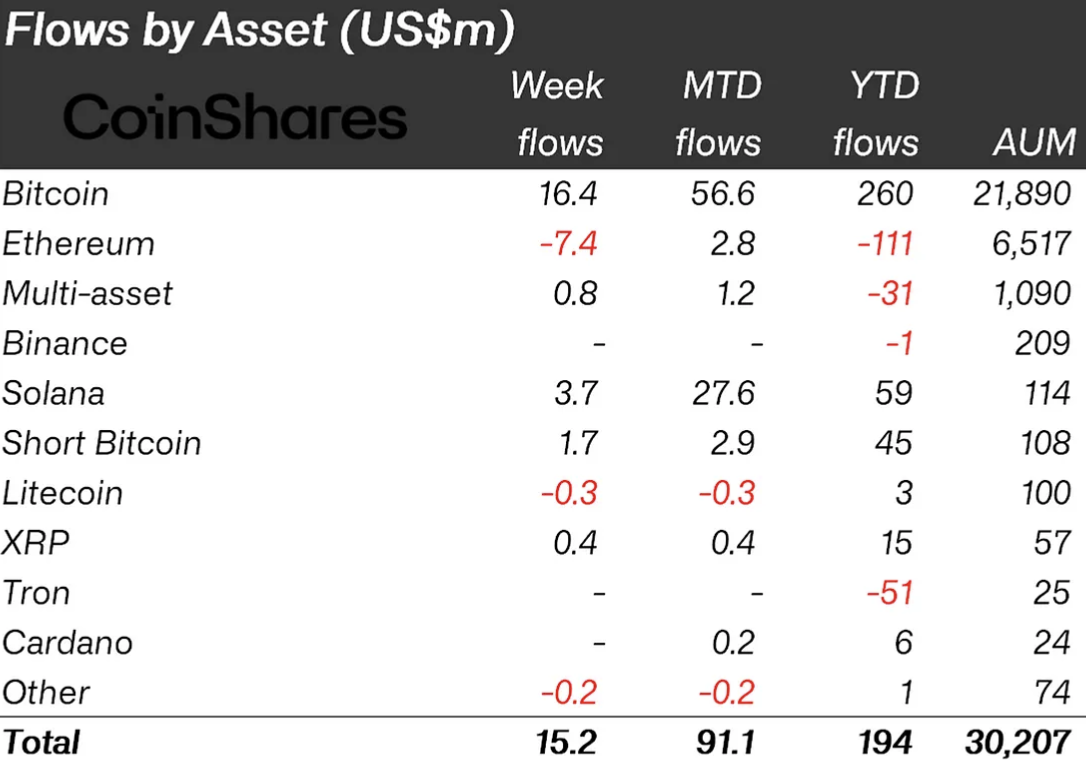

Thus, Bitcoin-focused ETPs attracted $16 million, bringing year-to-date inflows to $260 million. On the other hand, however, short Bitcoin investment products saw inflows of $1.7 million, indicating that there are still bearish-minded investors on the market.

For their part, XRP-oriented investment products demonstrated remarkable resilience, receiving $0.42 million last week, marking the 25th consecutive week of positive fund flows. Despite legal challenges throughout the year, consistent investor support of XRP was and is still evident.

Drawback

Nevertheless, it is not that shiny there as the report also revealed challenges faced by certain altcoins. Among others, Litecoin (LTC) and Chainlink (LINK) ETPs, which experienced outflows totaling $0.28 million and $0.31 million, respectively, indicate a challenging period for these digital assets.

The crypto market's main altcoin has also found itself in the mud as Ethereum, despite the launch of a futures ETF, has faced investor reluctance, with outflows totaling $7.5 million last week. These outflows, which partially offset significant inflows the previous week, can be attributed to concerns about the design of the Ethereum protocol.

In summary, Bitcoin and XRP continue to attract investor interest, as reflected in the report's data. While challenges persist for certain altcoins and Ethereum faces investor hesitance, the sustained inflows into BTC and XRP indicate positive trends at least for these two popular digital assets.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov