Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

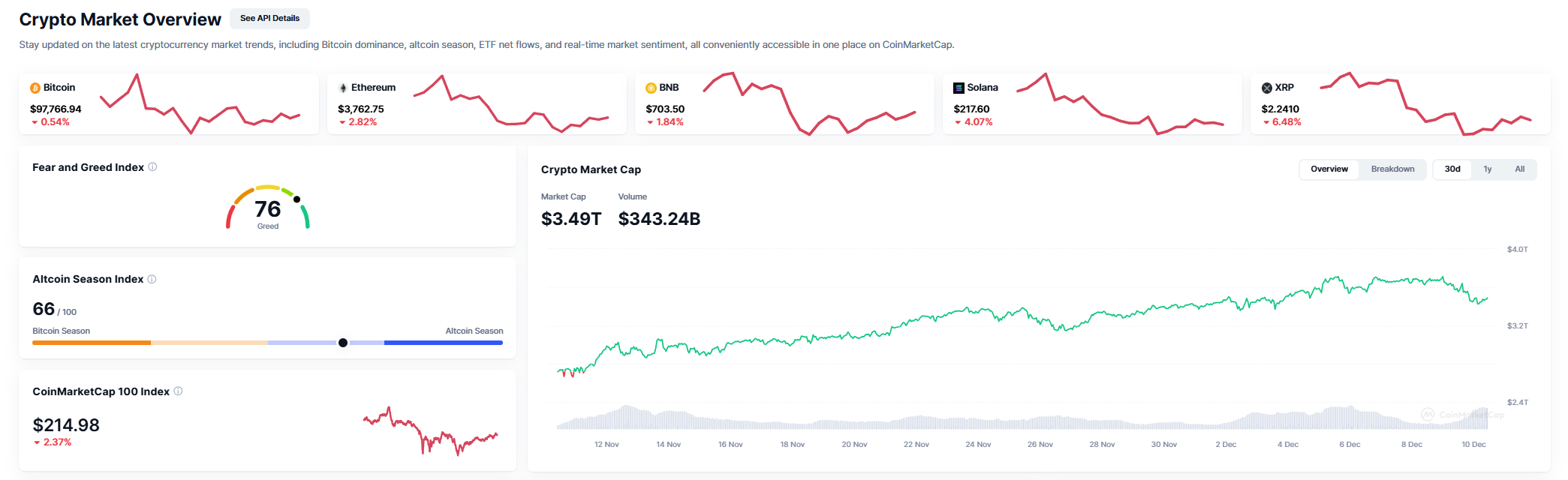

A series of corrections and liquidations on the cryptocurrency market has caused a significant setback, creating a $100 billion loss in market capitalization. Recent data demonstrates this dramatic drop, with the total market capitalization falling from $3.82 trillion to $3.62 trillion in a few short hours.

Such a precipitous decline is indicative of more general structural problems, mostly related to market-wide overleveraging. The main cryptocurrency at the heart of this turmoil has been Bitcoin. Its chart now indicates a critical correction phase, even though it previously showed resilience.

The psychological $100,000 mark has proven to be a strong barrier, and Bitcoin was unable to maintain its advance above it. As whales start taking profits, the short-term bullish momentum has started to wane, further straining the asset. At least in the short term, the likelihood of a further decline has increased since Bitcoin is currently trading below important EMAs.

The primary cause of this collapse is overleveraging. A total of $172 million of the $1.58 billion in liquidations over the last 24 hours are ascribed to Bitcoin alone, according to the liquidation heatmap. The bulk of these liquidations are due to short positions, which show that the market's aggressive long positioning is encountering resistance. As prices decline, this imbalance intensifies volatility and sets off a chain reaction. Ethereum has also seen large liquidations; in a similar manner, $229 million was lost.

Since assets like XRP, Solana and Dogecoin are also under downward pressure, the overall altcoin market is not doing any better. The current rally, which was driven by excessively optimistic market sentiment, is fragile, as this mass liquidation cycle highlights. A healthy correction is clearly needed, according to the market.

Resetting overextended positions and creating a more solid basis for future expansion require this stage. In the short term, there will probably be more volatility as the market adjusts, even though the overall outlook for cryptocurrencies is still favorable.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov