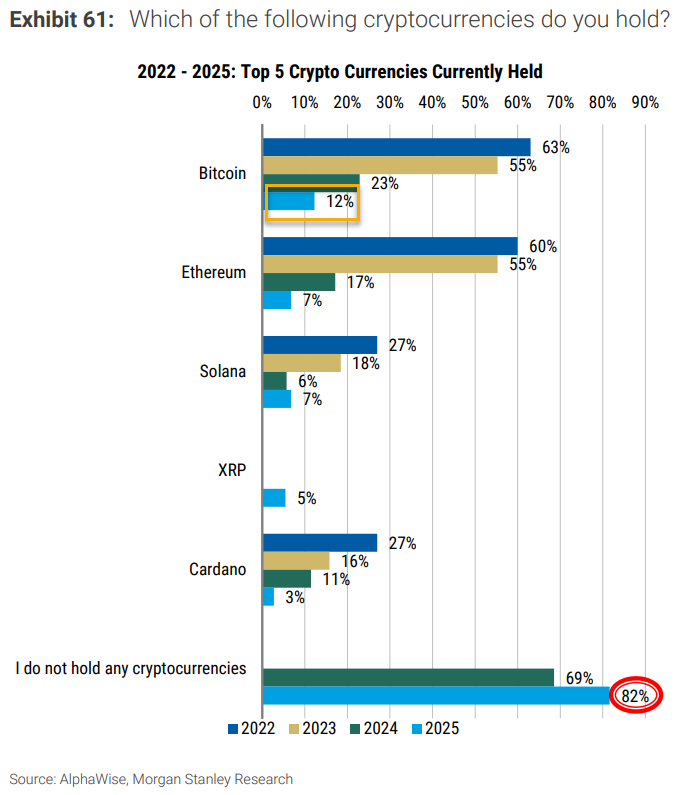

According to a Morgan Stanley Research survey, only 12% of the banking giant's EU interns now own Bitcoin.

For comparison, 63% of them held the largest cryptocurrency in 2022.

There has been a massive drop-off in cryptocurrency ownership, with a whopping 82% of the total respondents claiming that they do not hold digital currencies at all (compared to 69% in 2024).

Ethereum (ETH) has seen an even more stunning collapse (from 60% in 2022 to just 7% in 2025).

Cardano has witnessed a similar trend: the token went from 27% in 2022 to an infinitesimal 3% this year.

XRP bucks the trend

Still, XRP, which is currently the third-biggest token by market capitalization, has managed to buck the broader trend of young Morgan Stanley professionals souring from crypto.

The Ripple-affiliated token went from 0% to 5% in 2025, almost catching up with Ethereum (ETH). It is now a more popular option compared to Cardano (ADA).

This growth can most likely be attributed to XRP enjoying greater regulatory clarity, as well as the enormous rally in the fourth quarter of 2024 that grabbed tons of headlines.

A talent problem?

Austin Campbell, managing partner and founder of Zero Knowledge Consulting, argues that the banking sector has a talent problem.

Campbell, who previously worked at JPMorgan and Citibank, claims that

Interns who care about crypto and technology just "don't go to a bank at all now."

"But what is happening is young people hate banks, and the banks are increasingly out of touch with what is going on, moving from 1 generation to 2 generations to 3 generations behind on their understanding of technology," Campbell said.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin