Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

What does it take to emerge as a top choice for crypto derivatives trading? Enterprise-grade multi-factor security, innovative functionality (with a plethora of supported order types), and more. Derivatives, by their very nature, are instruments whose value is tied to the performance of underlying assets. Some of the most prominent types of derivatives include futures, forwards, options, swaps, etc. Crypto derivatives trading has many advantages, from helping traders reduce their risk to enabling price discovery and reducing costs.

However, for efficient trading, it’s not enough to just trade crypto futures, options, etc. To execute a successful trading strategy, one also needs to have a proper understanding of various trade order types. In this guide, we will walk you through the different crypto order types you can possibly execute, with popular exchange -Delta Exchange- as our context.

Basic orders

- Market order - A market order is one of the most basic forms of orders, as it buys or sells existing limit orders on the "order book." Only the amount of cryptocurrency to be purchased or sold will be specified in these orders, as the price at which they will be executed will be the best available price in the market at the time.

Traders typically submit market orders if they want to ensure that a trade is completed. Given how market orders are instant, they are issued by a trader to purchase or sell an asset like Bitcoin at the current price.

One of the most significant drawbacks of a market order is that when you place an order on an exchange, you essentially agree to the exchange filling your request at the "best price possible at the time." - Limit order - A limit order is an order to buy or sell a cryptocurrency when the market price reaches a certain level, and they are only executed when the market hits the specified limit.

Traders often aim to purchase and sell cryptocurrencies at predetermined prices in order to profit, which is why the market order function isn't always appropriate. The limit order is useful in this situation because it allows you to specify a precise price for your buy or sell order and instructs the exchange to fulfill it only if the market is prepared to meet or beat your price.

However, because you must wait for the market to satisfy your demand, one of the biggest disadvantages of using a limit order is that there is no guarantee that your deal will go through. - Stop order - A stop order is a type of order that allows you to define the price at which you want the order to be filled. Your order will then trigger a sell if it falls to that price. A stop order is similar to a limit order in that it is entered into the system, but it executes like a market order once the price is met.

Traders typically use stop orders to safeguard profits, reduce losses, and open fresh positions.

Advanced orders: The following are some advanced orders on Delta Exchange

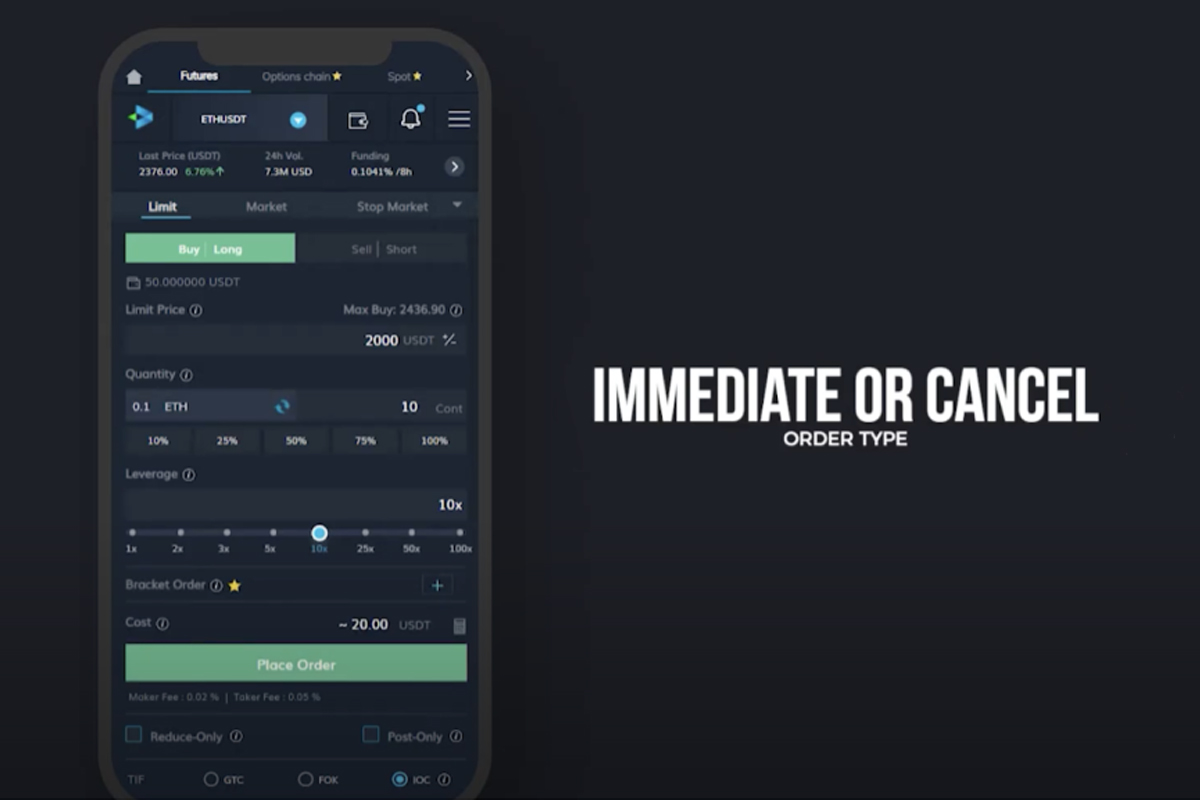

- Immediate or cancel order - An Immediate-Or-Cancel (IOC) order is a buy or sell order that must be filled right away. Any part of an IOC order that can't be fulfilled right away will be canceled.

- Fill or kill order - Fill or kill is a form of conditional time-in-force order that tells an exchange whether or not to execute a transaction immediately and completely. It is not possible to fill this order partially. If the order cannot be met, it is fully canceled.

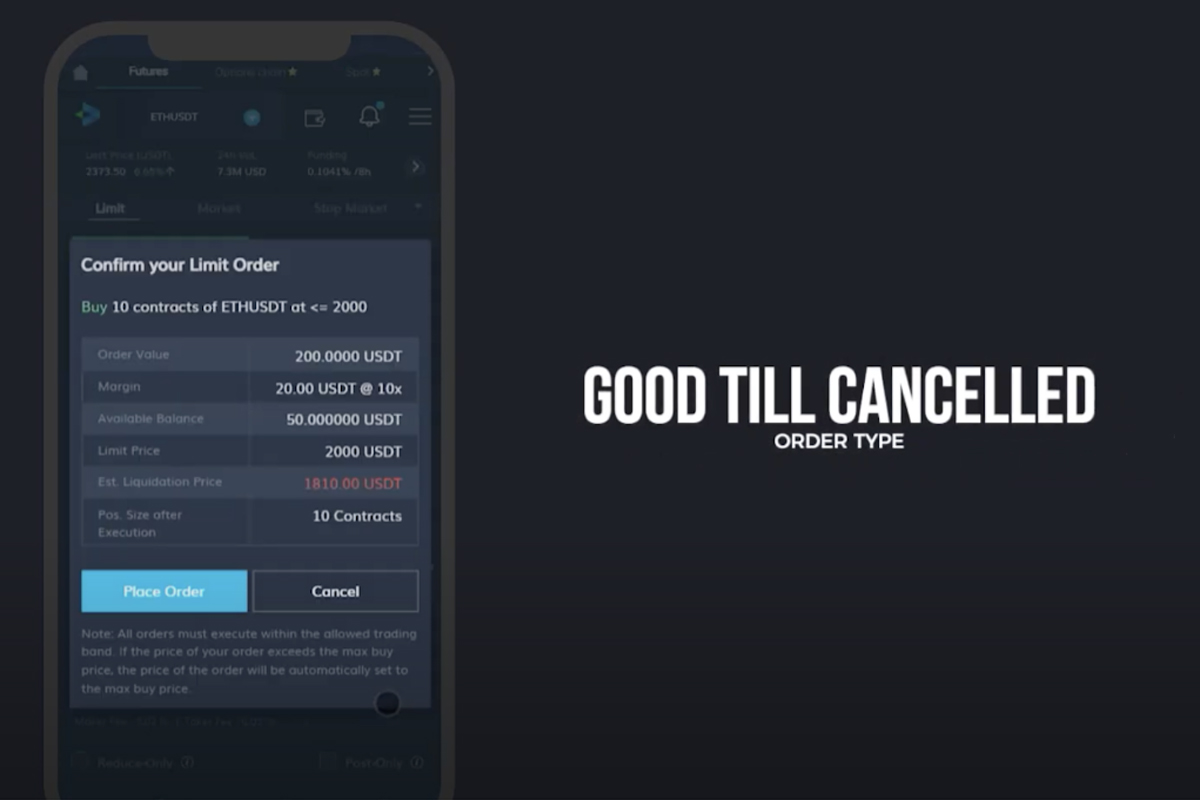

- Good till canceled order - A good till canceled (GTC) order is a buy or sell order that remains active until the investor has executed or revoked. Regardless of the time frame, this order works until it is canceled. Traders typically use this type of order to reduce the amount of time they spend managing their portfolio on a daily basis.

- Good till date order - A good till date (or day) order is one that is valid until the date indicated unless it has already been completed or canceled.

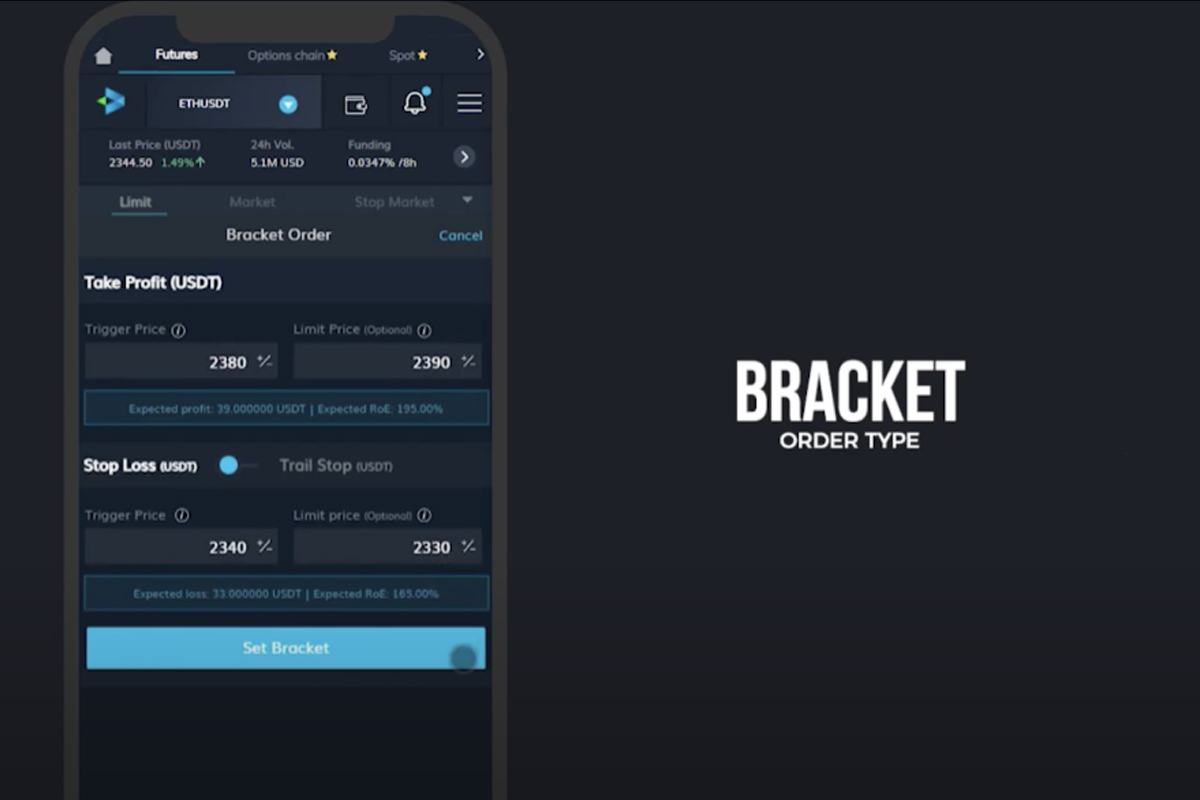

- Bracket orders - A bracket order is a type of order that allows a trader to start a new trade with a target price and a stop loss. When the trader executes the main order, he must also execute two other orders: a stop-loss order and a profit-taking order.

Crypto Derivatives Trading with Delta Exchange

Certainly, with the availability of several types of crypto orders and innovative derivatives products, Delta Exchange is a one-stop solution to meet all your crypto derivatives trading needs. To learn more about Delta, check them out on their Twitter, Facebook, Telegram, and Medium.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin