Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

As we witness a recent breakdown in XRP's price, here are three pivotal price levels that could serve as markers for the asset's short-term trajectory.

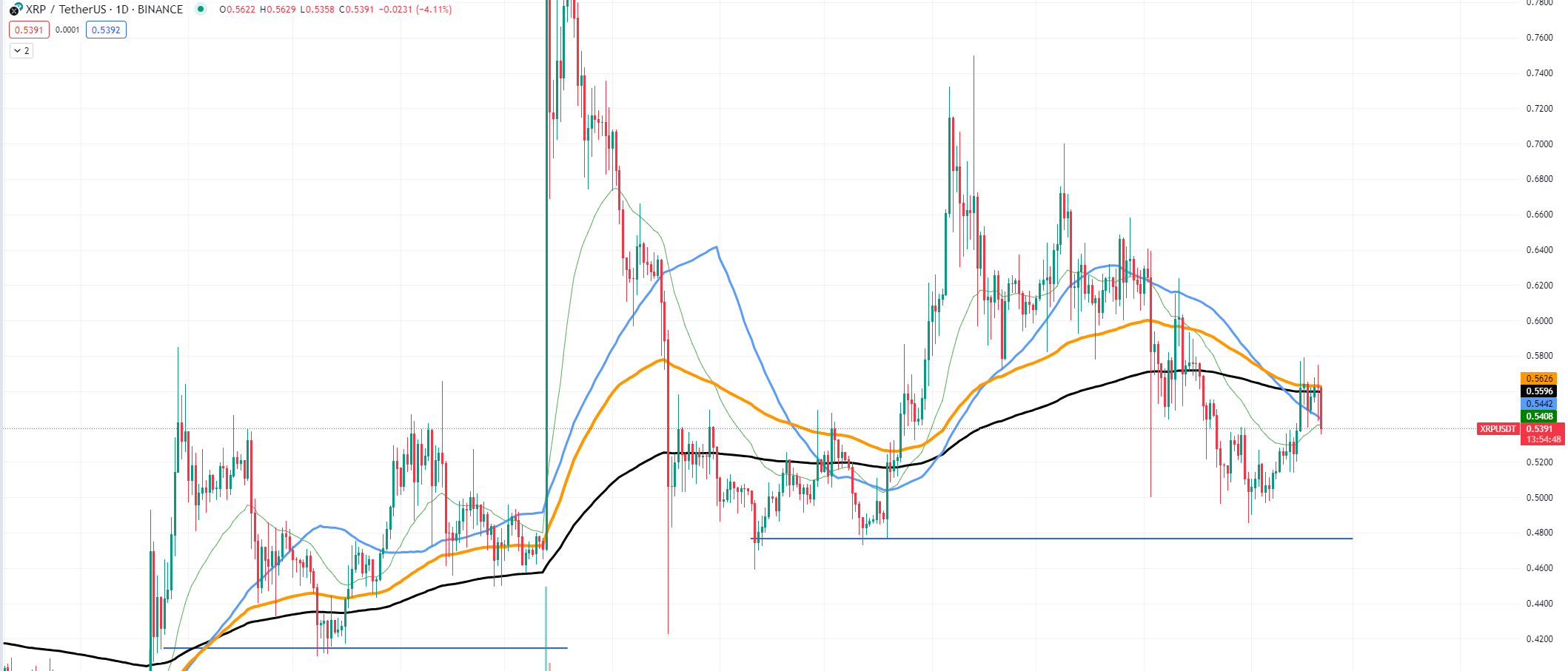

50-EMA standoff

XRP's immediate battleground is the 50-day EMA, a commonly watched technical indicator that serves to assess the asset's momentum over a median term period. Currently, XRP finds itself grappling at this juncture, making it a decisive point for either a rebound or a further descent. The 50 EMA acts as a dynamic support level which, if breached, could lead to an accelerated sell-off.

Half-dollar psychological and technical threshold

The $0.50 level stands out not only for its psychological significance as a round number but also for its historical role as a flip zone. This price point has previously acted as a reversal region, suggesting that buyers have stepped in at these levels before, potentially viewing it as a value area. A retest of this level could either reinforce it as a strong support or, if broken, could confirm bearish sentiment on the market.

$0.41 line in sand

Dipping further, the $0.41 level is a critical multi-year bottom that may serve as a last resort for bullish hopes. This level's significance is underscored by its historical precedence; any slip below this could point to a loss of investor confidence and potentially trigger a more profound capitulation.

In terms of resistance, specific levels to watch for include the recent local highs. If XRP attempts a recovery, it will first need to overcome immediate resistance near the $0.55 zone, which could act as a ceiling for any upward moves. Beyond that, the $0.60 level is likely to serve as the next significant hurdle, being a previous area of interest.

If XRP fails to hold these support levels, a bearish scenario could unfold. A breach below the 50 EMA may set off a domino effect with some substantial liquidations, with the price potentially spiraling down to test the $0.50 support. If this psychological and factual support gives way, the door would be open for bears to target the $0.41 multi-year bottom.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov