Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

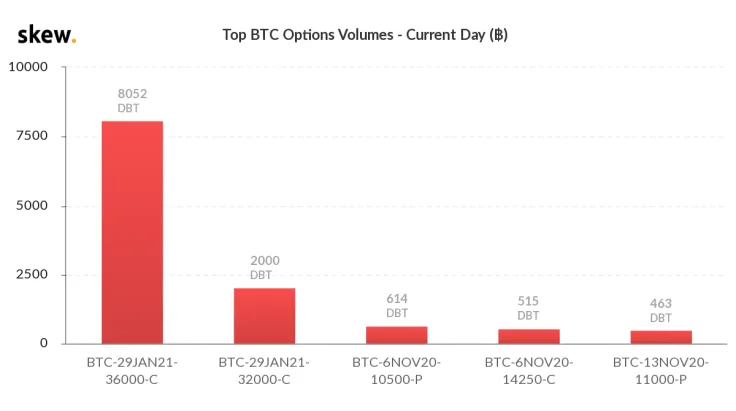

Skew and Deribit both reported that the largest Bitcoin (BTC) options trade has been filled. It indicates that the trader who placed the trade expects volatility to increase in the short term.

Researchers at Skew wrote 10,000 Jan 21 calls were filled, stating:

“10k Jan21 calls just crossed, looks like a 1x4 32k/36k Call Ratio. Largest listed trade ever on Bitcoin options.”

The trade itself is not a bullish or a bearish trade in the near term. Rather, it is a neutral bet on volatility in the foreseeable future.

Why Are Expectations For Volatility Climbing?

According to Deribit, 16,000 BTC contracts were traded in the Jan 36k call. Since call options were used, which are buy orders, the trade cannot possibly be bearish.

But, due to the complexity of options contracts, it is difficult to say that the trader expects Bitcoin to increase substantially. Given that the options themselves were cheap, it is likely that the trade is a play on volatility, not price.

“16k BTC contracts traded just now in the Jan 36k call, and with that, we have a new Record of 47K BTC contracts traded. Wow!” Deribit wrote.

There are several reasons a trader might file a major Bitcoin options trade in the current environment.

First, the U.S. presidential election is nearing and is now merely six days away. The U.S. stock market has already been volatile in the lead-up to the election. Upon the election, especially if it is a contested one, that could spur more volatility in the Bitcoin market.

Second, Bitcoin recently tested a resistance level at $13,875, which has acted as a ceiling for BTC since 2018. A high level of volatility is likely in the near term as the uncertainty around the price direction strengthens.

Su Zhu, the CEO of Three Arrows Capital, pinpointed that the Deribit options market’s 24-hour volume hit an all-time high as a result. He wrote:

“Last 24hr volume on BTC options on Deribit at 47k BTC, which is an all-time high. 29th Jan 2021 36k strike now 16k BTC open interest.”

The Bitcoin Derivatives Market is Flying Overall

In the past week, the Bitcoin derivatives market has seen a significant upsurge in volume, in general. The futures market, led by Binance Futures and CME, saw its 24-hour volume rise substantially in a short period.

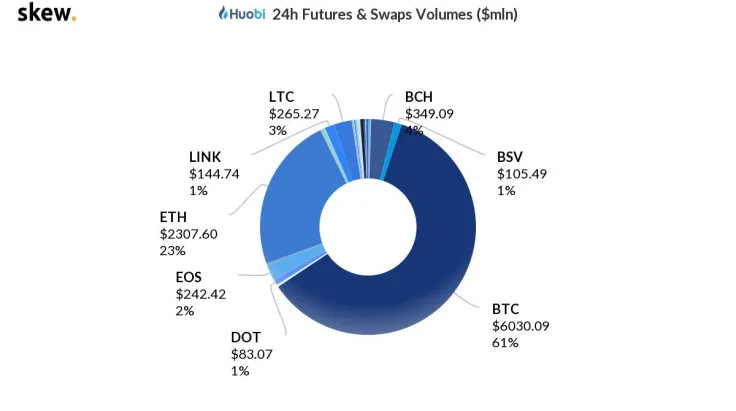

The Bitcoin options and futures markets have particularly increased in the past two weeks due to the growing dominance of BTC. According to Skew, major exchanges, including Huobi, saw BTC take the majority of the market share convincingly.

On Oct. 29, Huobi, which has one of the biggest Bitcoin exchange reserves at 1.1% of the entire supply, saw BTC account for 61% of the entire futures volume.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov