Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

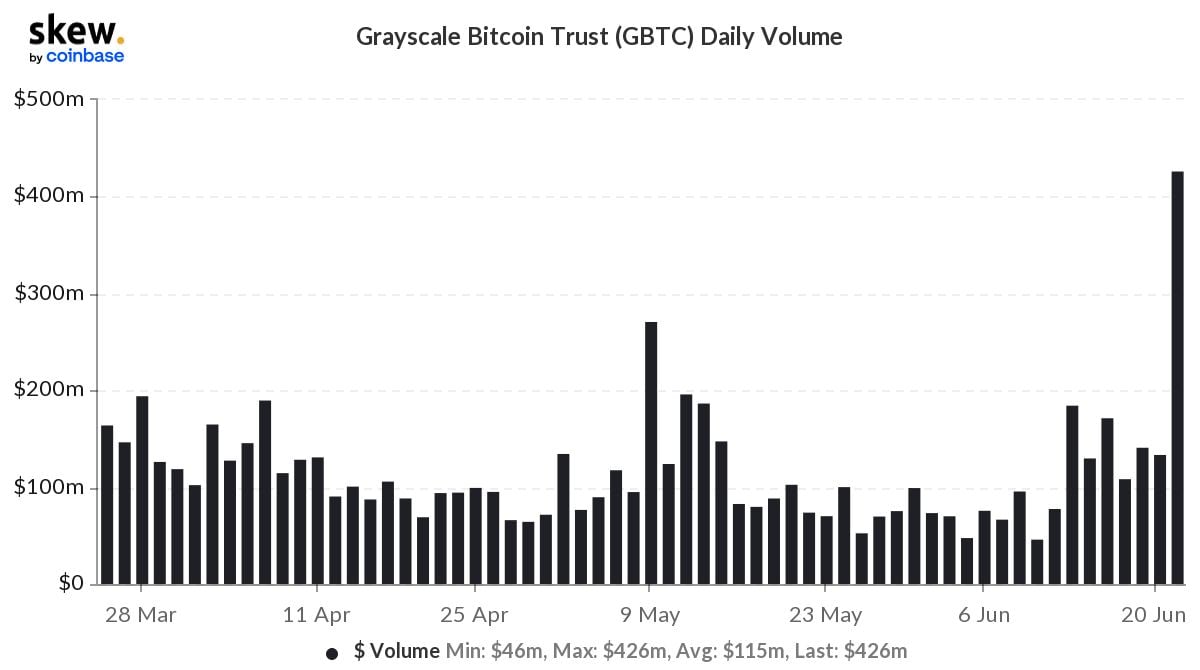

Before the appearance of Bitcoin futures exchange-traded funds, the majority of institutional investors received exposure to the cryptocurrency market via private funds like Grayscale, but during the correction of the crypto market, the fund lost all of its gains and even entered a discount zone, which is now rapidly shrinking.

Grayscale's discount

Grayscale's premium and discount to NAV allows traders and investors to get exposure to the cryptocurrency market with the potential to maximize their profits thanks to the large discount that may turn into a premium at some point.

Unfortunately, the correction on the cryptocurrency market caused most institutional and private investors that were holding GBTC shares to drop their positions even with a massive discount, pushing it all the way down to 35%.

While the Bitcoin fund's discount may seem impressive, alternative currency funds are looking even more ridiculous as GETH fund offers Ethereum exposure for half the price.

Ultimate bounce indicator

Grayscale saw a shrinking of the existing discount of almost 8%, which could be the ultimate indicator of an upcoming bounce on the cryptocurrency market as institutions gained exposure to crypto after dropping their bags when Bitcoin was tumbling from $30,000 to almost $17,000.

Previously, U.Today mentioned that Grayscale's fund may not return to the "premium zone" as it is not as in demand as a tool of institutional exposure as it was before. But it seems that fresh funds can yet push the value of assets to NAV up.

At press time, Bitcoin trades at around $20,000, and the GBTC fund discount stays at around 27%.

Gamza Khanzadaev

Gamza Khanzadaev Arman Shirinyan

Arman Shirinyan Dan Burgin

Dan Burgin Alex Dovbnya

Alex Dovbnya