Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

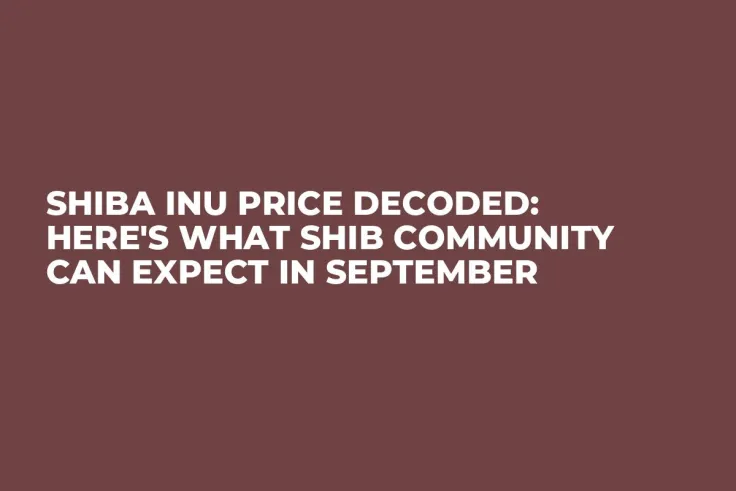

Shiba Inu's token, SHIB, appears to be heading for an unprecedented downturn as August draws to a close, marking the first instance of negative performance since its inception three years ago. The token's track record shows an impressive history, with August gains of 10.1% in 2021 and 3.36% in 2022. However, this year's August is poised to conclude with a disappointing 4.2% drop.

September emerges as a pivotal month for this popular cryptocurrency, as historical data unveils a mixed narrative. Over the years, the Shiba Inu token has experienced a roller coaster ride in September, with an average profitability of -0.89% since 2021. Notably, the past two years witnessed a 4.65% gain and a 6.43% loss, respectively, showcasing the volatile nature of SHIB's September trajectory.

Drawing parallels from the larger crypto market, Bitcoin and Ethereum present intriguing insights. BTC's average September returns since 2013 stand at -6%, while ETH, a more relevant comparison due to its altcoin status like SHIB, paints a grimmer picture with an average return of -14.1%.

Analyzing SHIB's September potential in a different light, we turn to Dogecoin (DOGE), a historical sibling in the crypto world. DOGE's average September gain hovers around 14.5%, predominantly driven by standout years like 2014 and 2018. Nevertheless, a more reliable indicator, the median profitability of -4.07%, tempers expectations.

As the SHIB community looks ahead to September, caution is advised. The crypto market thrives on surprising trends and unexpected turns, making resilience and adaptability paramount for investors.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov