Have you ever wondered why with all the risks and problems associated with using centralized exchanges (CEX) a lot of people are still using them? If you look at the many cryptocurrency data aggregation sites it is almost a guarantee that CEXs will always have a much higher trading volume than any other alternative trading venues such as decentralized exchanges (DEX). But are CEXs better? Given the history of security breaches, CEXs have been identified as one of the weakest links in terms of security in the cryptocurrency industry, hence the short answer is an emphatic no.

One of the largest accounting firms in the world, KPMG, pointed out that at least there have been around $9.8 billion in cryptocurrencies stolen by hackers since the year 2017. It is not surprising that CEXs contributed to a large portion of this figure. According to KPMG, investors, especially institutional ones, will not risk owning cryptocurrencies if they cannot be secured and this is hampering mass adoption. Interestingly there exists an alternative trading venue that is more secure than CEXs but has been struggling to gain the same level of attention and traction as its CEX counterpart.

DEX Provides Superior Security

Before we delve into what might be the reasons behind this phenomenon, let me first qualify my argument that DEXs are way better than CEXs. DEXs are more secure for the simple fact that all traders never lose custody of their digital assets. Take for example Newdex, once trades are executed their funds are sent to an entrustment account that is governed by a smart contract and automatically matches and settles the trade when certain conditions are met. Transactions are consummated on-chain and Newdex operators never lay their hands on customer’s funds.

Since digital assets never leave the custody of their owners it is more secure. Unlike centralized exchanges where users are required to deposit their funds. By doing so they have exposed themselves to the several risks associated with it such as the higher threat of hacks, restriction of access to funds and essentially all the business risks of the exchange. On the other hand, DEXs do not have a user account system and users have total control of their assets so long as they keep their private keys they will enjoy the blockchain’s security.

Why Traders Still Prefer Centralized Exchanges

Now let me explain why despite this obvious advantage of DEXs many still prefer to use Centralized Exchanges. The most obvious reason perhaps is people tend to think that Centralized exchange with all their years of experience, technical expertise, and security systems is the most secure place to store their digital assets, of course, this is not true for reasons we have already stated above. A lot of these exchanges are relentless in marketing themselves as a safe venue for trading hence this belief prevails.

Another reason is perhaps the convenience these CEXs provide. Once a user opens an account in centralized exchanges they have instant access to several hundreds of cryptocurrency wallet addresses. They don’t have to go through all the hassle of having to secure each and every private key of the wallets they want to use. More importantly, they will be able to trade across different blockchains which is a major problem with decentralized exchanges which is basically limited to the blockchain of the wallet they use. This makes it a challenge for DEXs to create trading pairs beyond a single blockchain.

The challenges of Decentralised Exchanges to creat trading pairs of different blockchains is perhaps the primary reason why even experienced traders who know that risk of trading on centralized exchanges still uses them. Liquidity is the single most important factor in why many of them prefer to use centralized exchanges. There are many projects that are currently developing interoperability solutions but are still largely under development. However, there are some decentralized exchanges that are finding ways to address this problem.

Addressing This liquidity Problem

Take for example Newdex whose developers have been hard at work constantly researching ways how to address this major challenge. Previously they have started supporting several different chains in their platform, supporting sister chains of EOS as well as the Tron blockchain. To enhance liquidity even further they also started multi-chain support of the biggest stablecoin in the market USDT (TRC20 USDT, ERC20 USDT, and EOS USDT). Recently they launched BTC/USDT and ETH/USDT trading pairs for cross-chain trading and just like that they have included two of the biggest cryptocurrencies in terms of market capitalization in their platform.

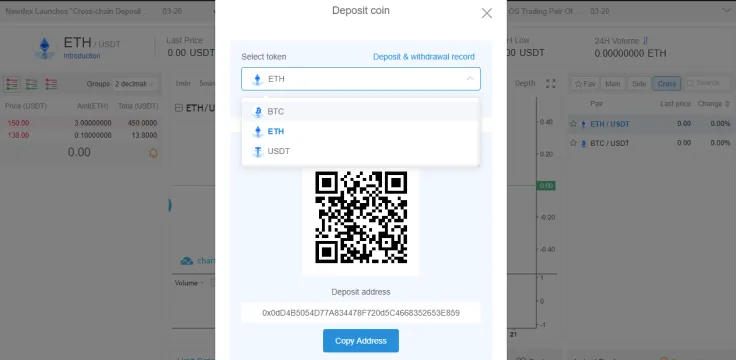

Newdex was able to do this by creating BTC, ETH and USDT pegged assets that can easily be used within the Decentralized Exchange. When a user deposits BTC, ETH or USDT into Newdex they are converted into digital assets pegged in BTC, ETH or USDT respectively. The pegged assets can now be used to trade and can easily be converted back to its native form just by triggering a withdrawal.

The cross-chain deposit and withdrawal function of Newdex is better than the same function in centralized exchange. Because the transaction of BTC and ETH users deposit to Newdex can be checked on BTC and ETH blockchain. The pegged BTC and ETH Newdex launched are also checkable on the EOS chain. Thus it is more transparent compared to Centralized Exchange and avoids the risk of misappropriation of the exchange operators.

To learn more about this feature you might want to read this short tutorial from the support page of Newdex.

Conclusion

Liquidity has always been the problem in decentralized exchanges but DEXs like Newdex have been finding innovative ways how to address this problem. While there is still a lot of work to do, the DEXs like Newdex will continue to work hard exploring different solutions for cross-chain trading technology and perhaps one day will be able to offer us the same level of liquidity that CEXs has to offer. For now, let us enjoy the many innovations in decentralized exchanges. If you are not still into DEX trading you might as well start learning how to do it now as sooner or later they will become the dominant force behind decentralized and alternative finance.

Disclaimer: This is sponsored content. The information on this page is not endorsed or supported by U.Today, and U.Today is not responsible or liable for any inaccuracies, poor quality, advertising, products or other materials found within the publication. Readers should do their own research before taking any actions related to the company. U.Today is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the article.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov U.Today Editorial Team

U.Today Editorial Team