Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

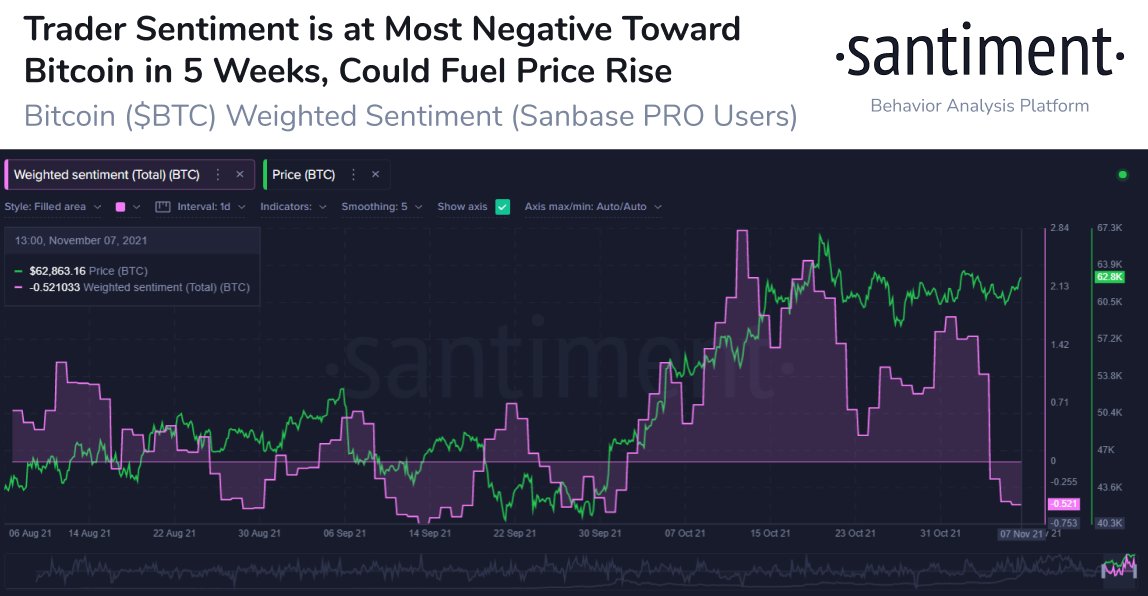

Previous Bitcoin price action was followed by a significant plunge in traders' sentiment. While Bitcoin was moving without strong buying power in the $63,000-$58,000 range, traders started to lose their optimism, according to Santiment.

While the provided data might sound contradictory, there is, in fact, an inverse correlation between Bitcoin's price and overall trader sentiment. A strong drop in sentiment has usually been followed by a strong price increase right after.

Historically, prices on the cryptocurrency market are generally moving in the opposite direction of the crowd's expectations. While rallies may be fueled by the retail traders, in periods of correction or consolidation, whales are usually the ones that change the direction of the market.

Previously, on-chain data suggested that the percentage of whales on the cryptocurrency market has been increasing exponentially, which is usually considered a positive thing for the cryptocurrency market since whales tend to pump the market rather than crash it.

As of now, Bitcoin traders' sentiment has hit September lows right before its price jumped back above $65,000. At press time, Bitcoin's trading volume does not seem to break any local records, which indicates that retail traders are not interested in selling or buying right now.

At press time, Bitcoin has reached the previous Oct. 20 high of $66,283 and is now trading with 4.5% profit but is still failing to go through the previous top resistance.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov