Two popular analytics agencies—Glassnode and CryptoQuant—seem to have totally different interpretations on the recent 18,670 BTC transaction related to the Gemini exchange. This transfer is believed to have caused the massive Bitcoin sell-off that led to its decline to the $56,000 level.

Now, IntoTheBlock has joined the discussion and appears to offer data that neither CryptoQuant, nor Glassnode, had announced.

Where did 18,670 BTC come from?

On March 15, CryptoQuant reported that $1,031,498,830 worth of Bitcoin (approximately 18,670 BTC) was transferred to the Gemini exchange owned by the Winklevoss twins, Cameron and Tyler—vocal Bitcoiners and billionaires who lost Facebook to Mark Zuckerberg in court when it was founded.

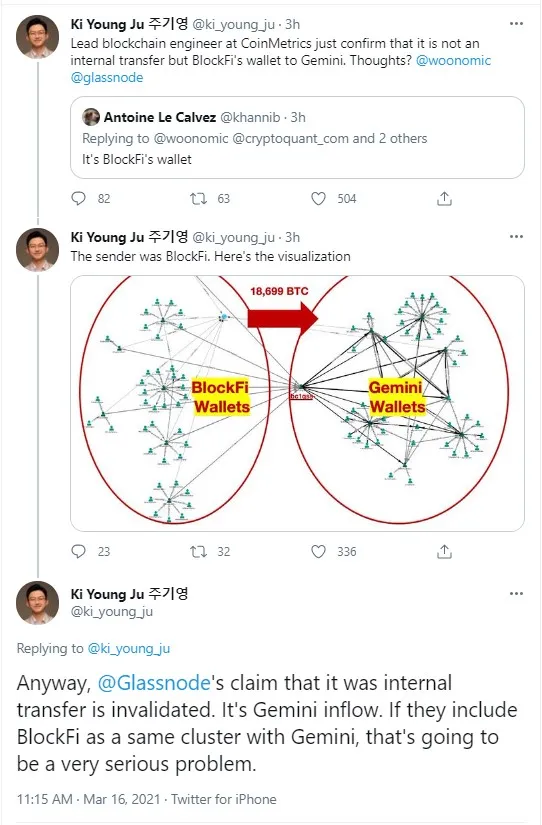

CryptoQuant analytics firm stated that Glassnode was wrong to have labeled the transaction as an internal one between Gemini wallets.

The CryptoQuant CEO, Ki Young Ju, is positive that it was a whale making a mammoth-sized deposit to Gemini, and this data was confirmed by an expert from CoinMetrics, according to him.

Glassnode stands firm on its verdict

Today, Ki Young Ju tweeted that the transaction to Gemini was performed from BlockFi (an exchange and a crypto lending service).

In today's tweet, Glassnode maintained its position, stating that the aforementioned Bitcoin transfer was nothing but an internal one on the Winklevoss' exchange.

Addressing yesterday’s exchange data – we remain with our statement. The transactions in question were not external user deposits into Gemini's cluster. This is in accordance with our address labels and clustering information.

Popular crypto trader and analyst Willy Woo was also involved in the discussion, calling CryptoQuant's data bogus.

IntoTheBlock first confirmed the deposit to Gemini, then added that slightly over 17,000 BTC was later withdrawn.

However, IntoTheBlock chose to remove all of its tweets regarding this transaction.

Bitcoin tanked from $60,000 as a result

On Monday, the world's major cryptocurrency, Bitcoin, plunged from the $60,000 level to the $55,600 area on a massive sell-off.

It was believed to be triggered by this billion USD in Bitcoin deposited to Gemini as the market assumed a whale was going to sell it.

The CEO of Galaxy Digital, Mike Novogratz, told CNBC yesterday that despite Bitcoin's surging to $61,700 on Saturday and its decline to $55,500 on Monday, Bitcoin simply rolled back to where it was on Friday afternoon.

According to crypto billionaire Novogratz, the BTC upsurge over the weekend was due to retail purchasing as leverage, which always goes higher on the weekend.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin