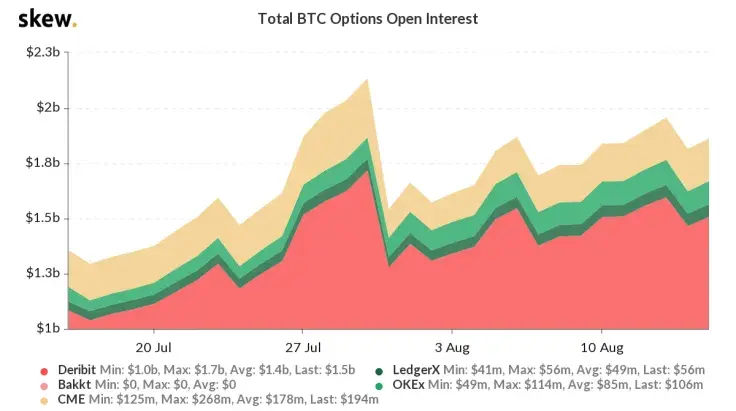

The open interest of the Bitcoin options market is still hovering at $1.5 billion. The data suggest the market is anticipating a spike in volatility, despite BTC’s 30% rally since July 21.

The aggregated open interest of the Bitcoin futures market is also near its monthly high at $5 billion. The significantly high number of active futures and options contracts suggest the market is speculating a volatile period ahead.

The term open interest refers to the total amount of all active contracts open in the market. If the open interest is high, it means there are a large number of investors betting for or against Bitcoin, anticipating a price movement.

Why the markets possibly expect a volatile Bitcoin trend in the near-term

In recent months, various macro factors affected the trend of Bitcoin. For instance, the correlation of BTC with gold, rising inflation, and a gloomy global economic outlook led the sentiment around BTC to improve.

Whether the market expects a correction or a rally to occur in the short-term remains uncertain. There are compelling data points to support the chances of both an uptrend and a pullback. But the data show the markets are preparing to see intense price action.

A few reasons could be causing the market to brace for a volatile cycle. First, fundamentals are strong for Bitcoin. The hashrate of the Bitcoin blockchain network is nearing an all-time high, which suggests a stable mining industry. Second, institutions have been aggressively investing in Bitcoin, as UToday previously reported.

The hashrate of the Bitcoin network is a solid metric to measure the sentiment of miners around the industry. The hashrate is crucial because it directly shows the level of computing power that secures the Bitcoin blockchain network. If the hashrate is higher, then the level of security of the network increases.

Researchers at CoinMetrics said the CMBI Bitcoin Hash Rate Index has reached an all-time high. Miners have continued to mine BTC at a growing capacity since the May 11 halving, which could be considered as a positive catalyst. The researchers said:

“The CMBI Bitcoin Hash Rate Index is currently at all time highs If hash rate remains at current levels, Bitcoin's difficulty will adjust in about 1 week to new all time highs as well”

But, several technical factors, such as the presence of a major resistance area, as said by on-chain analyst David Puell, could slow down the momentum of BTC. Puell explained:

“CIH is the delta between two volume profiles (in this case from 2018 onward): bitcoins unmoved (assumed as hodling) and bitcoins moved (assumed as distribution). Three levels of major buyouts are noticeble—two remain as major demand zones; one as a last major resistance.”

The market seemingly remains undecided over the short-term trend of Bitcoin, with positive and negative factors coming into play. Consequently, the open interest in the futures and options market has increased, raising the chances of a volatile phase for Bitcoin.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin