Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Grayscale, the investment firm behind the Grayscale Bitcoin Trust, raised $217 million in a single week. It was the company’s largest fundraising week ever, hinting at rapidly-increasing institutional demand.

Barry Silbert, the CEO of Grayscale, said:

“Thrilled to share that Grayscale had our largest fundraising week EVER...$217 million invested into the Grayscale funds. Guess you liked the commercial!”

The record fundraising week comes after Grayscale debuted a new commercial TV ad campaign.

Institutions are paying attention to Bitcoin

Various metrics suggest that the inflow of capital from institutions into Bitcoin is continuously increasing.

The assets under management (AUM) of the Grayscale Bitcoin Trust is hovering at $3.55 billion. The company recorded $1.4 billion in inflow in the first half of 2020, mainly driven by institutions.

On July 15, Grayscale said:

“Asset raising increased significantly this quarter with 80% more capital raised compared to 1Q20, amounting to $905.8 million invested in our family of products. This record demand for Grayscale products quarter-over-quarter reflects increased demand for digital assets from individual and institutional investors alike.”

Earlier this week, a billion-dollar public company MicroSolutions purchased more than $250 million worth of Bitcoin as the firm’s primary treasury asset. Prior to that, Grayscale also bought 14,422 BTC, worth $170 million.

Large-scale bulk purchases of Bitcoin among institutions are increasing, and institutional products’ demand is rising in tandem.

The growing capital from institutions hitting the Bitcoin market suggests that the broader financial industry is beginning to consider BTC as a store of value.

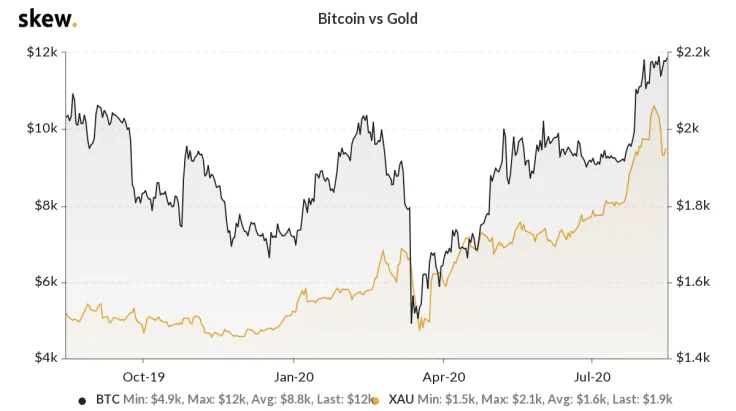

Correlation with gold further boosts the store of value narrative

According to cryptocurrency market data provider Skew, the correlation between Bitcoin and gold is reaching all-time highs. The company said:

“Bitcoin/Gold 1 mth correlation reaching new all-time highs, giving momentum to the store-of-value narrative for BTC in these ‘money printer go brrr’ times.”

The correlation between Bitcoin and gold, especially during a time when prominent investors, like Berkshire Hathaway’s Warren Buffett, are obtaining exposure to gold.

On August 15, Buffett and Berkshire Hathaway dropped shares in major banks, including Goldman Sachs, and bought a gold mining company Barrick Gold.

Investors and strategists say Buffett’s entrance in to the gold market could eventually catalyze Bitcoin. Gabor Gurbacs, a director at VanEck, said:

“Warren Buffett said he would never invest in gold. He did invest in gold miners because it made sense. Warren also said that he would never invest in Bitcoin. I am waiting for the day when Warren changes his mind on Bitcoin.”

The confluence of bitcoin and gold correlation, rising capital inflow from institutions, and the growing demand for gold are seemingly making Bitcoin more compelling to institutions.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin