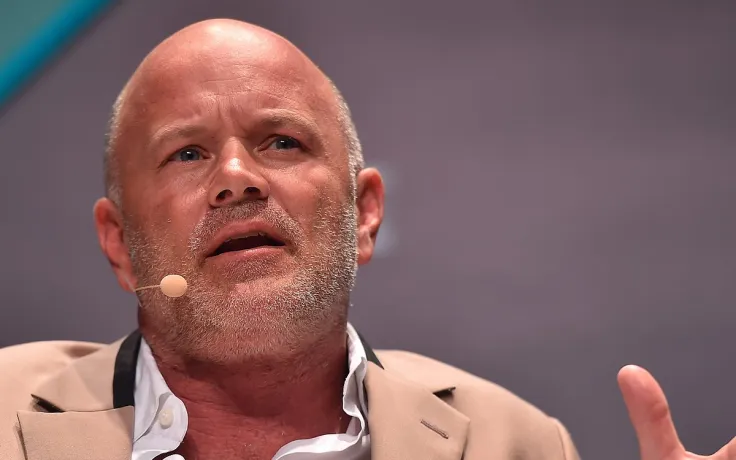

On Thursday's broadcast of CNBC's "Squawk Box," Galaxy Digital CEO Mike Novogratz warned that Bitcoin could go down together with stocks because there is too much correlation with risk assets:

If the S&P was down 20 percent in the next three days, Bitcoin would be lower, not higher.

He predicts that high-flying stocks like Tesla (TSLA) are eventually going to "reverse hard":

You've got to watch for cracks. One day, we will wake up, and markets will be reversing, and then they will reserve hard.

Advertisement

Money printers have no rest

Senate Minority Leader Chuck Schumer—who will now preside over the upper chamber of the U.S. Congress following the run-off election in Georgia—asserted that the $2,000 stimulus checks will be one of the very first priorities for the Democrats.

The willingness of the government to print even more money to provide aid amid the raging pandemic did not go unnoticed by Bitcoin investors. The cryptocurrency soared by over 20 percent in just three days after it became clear that fiscally responsible Republicans lost control of the Senate after winning it back in 2014.

Novogratz predicts that, as in April, some of the upcoming stimulus checks will find their way into the market:

When it comes to young people's hands, they are going straight to Robinhood accounts.

Bitcoin could decouple from stocks

Novogratz adds that it is "really hard" to see how central banks can deal with a giant deficit that keeps getting bigger.

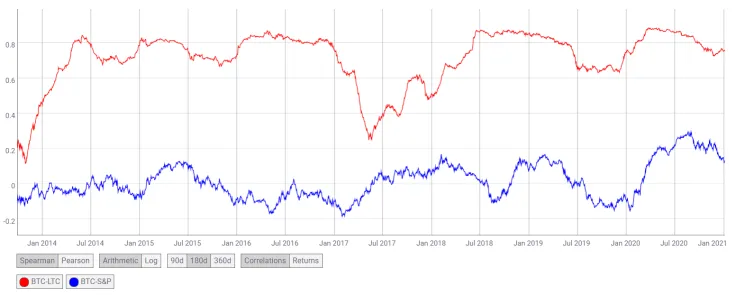

While Bitcoin is currently correlated to risk assets, he expects that this trend will be short-lived:

I do think Bitcoin is going to stay correlated to risk assets in the short run, but that correlation will continue to go down as more people are getting into this community.

He mentions that it is "shocking" for him to see so many institutions now gaining exposure to the cryptocurrency.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin