Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

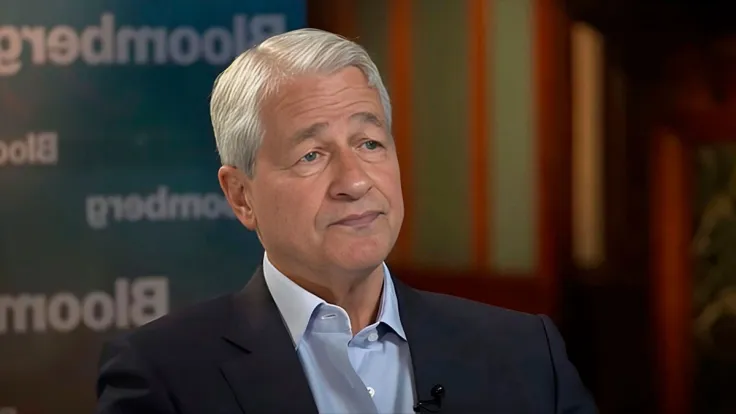

JP Morgan CEO Jamie Dimon has issued a warning with consequences for the markets. This latest warning has left many investors wondering about the implications for various asset classes, particularly cryptocurrencies.

According to CNBC, the JPMorgan CEO issued a warning about inflation on Friday despite recent signs of easing in price pressures. Bitcoin rose more than 2% in today's trading session, surpassing $58,000.

"There has been some progress bringing inflation down, but there are still multiple inflationary forces in front of us," Dimon said in a statement accompanying the bank's second-quarter earnings. "Therefore, inflation and interest rates may stay higher than the market expects."

Dimon's remarks come after this week's data revealed that the monthly inflation rate fell in June for the first time in more than four years, fueling speculation that the Federal Reserve might drop rates soon.

Fed Chairman Jerome Powell expressed concern earlier this week that keeping interest rates too high for too long could damage economic development, hinting that rate cuts could be on the way if inflation continues to rise.

Will Bitcoin react?

Bitcoin dipped to lows last seen in February in this week's trading as this year's record-breaking rise shows indications of exhaustion in the lack of new market drivers. Concerns over Mt. Gox, the German government's Bitcoin sales and the potential of higher-for-longer U.S. borrowing costs had sapped the cryptocurrency market.

After reaching an all-time high of about $74,000 in mid-March, Bitcoin has fallen by about 21%. Contributing to the decline are fluctuating expectations for U.S. interest rate reduction, which have reduced demand for most risky assets.

Stubborn inflation prompted traders to lower their expectations for Federal Reserve interest rate reduction this year, posing a challenge to speculative assets such as cryptocurrency. At the time of writing, BTC was up 1.18% in the last 24 hours, trading at $58,527.

In the coming days, the market will be watching to see how JP Morgan CEO's inflation warning will affect cryptocurrencies.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin