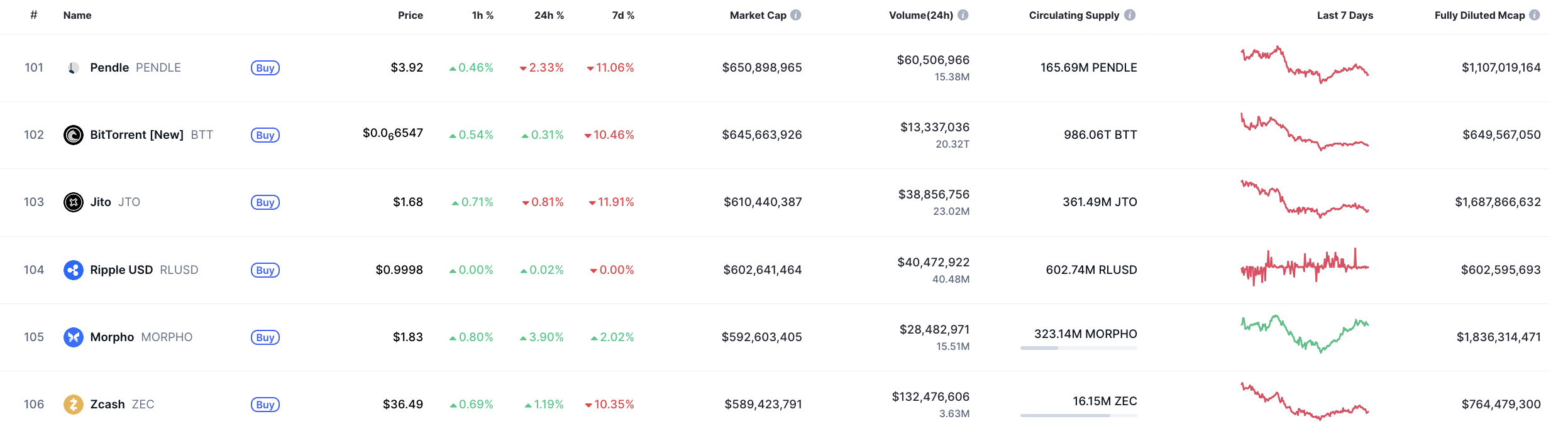

Ripple USD (RLUSD), Ripple's dollar-pegged stablecoin, has officially overtaken Zcash (ZEC) in market capitalization, securing 104th place on the global crypto leaderboard. The stablecoin is still worth $1, but its market cap has now reached $602.6 million, just ahead of ZEC, which dropped to 106th following a broader seven-day decline of nearly 12%.

The change in rankings happened rather under the radar. It is just steady growth in the adoption rate, with over 602 million RLUSD already out there and daily trading volume now topping $35.8 million.

That puts it ahead of many tokens that cost a lot more per unit, including some mid-cap altcoins that have not been able to keep investors interested during the recent market slowdown.

Zcash's decline is just the latest sign of a wider problem with legacy privacy coins. These coins are losing their appeal and their use is dropping, at least for now. Even though ZEC costs $36, it is now being overtaken in trading activity and capitalization by a stablecoin that is not supposed to increase in price, but rather to hold its peg.

RLUSD vs. stablecoins

What makes RLUSD's rise even more interesting is where it sits among a new generation of stablecoins that are all but invisible as they gradually gain market share. It is now almost as big as PayPal USD and First Digital USD, which suggests that Ripple's stablecoin experiment is becoming more than just a backend utility — it is really taking off.

If the mid-tier tokens keep dipping, it is likely that RLUSD will soon be in the top 100 — not because of any sudden surge, but more because of consistent growth. On markets like this, stability is starting to look like a real plus.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin