Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

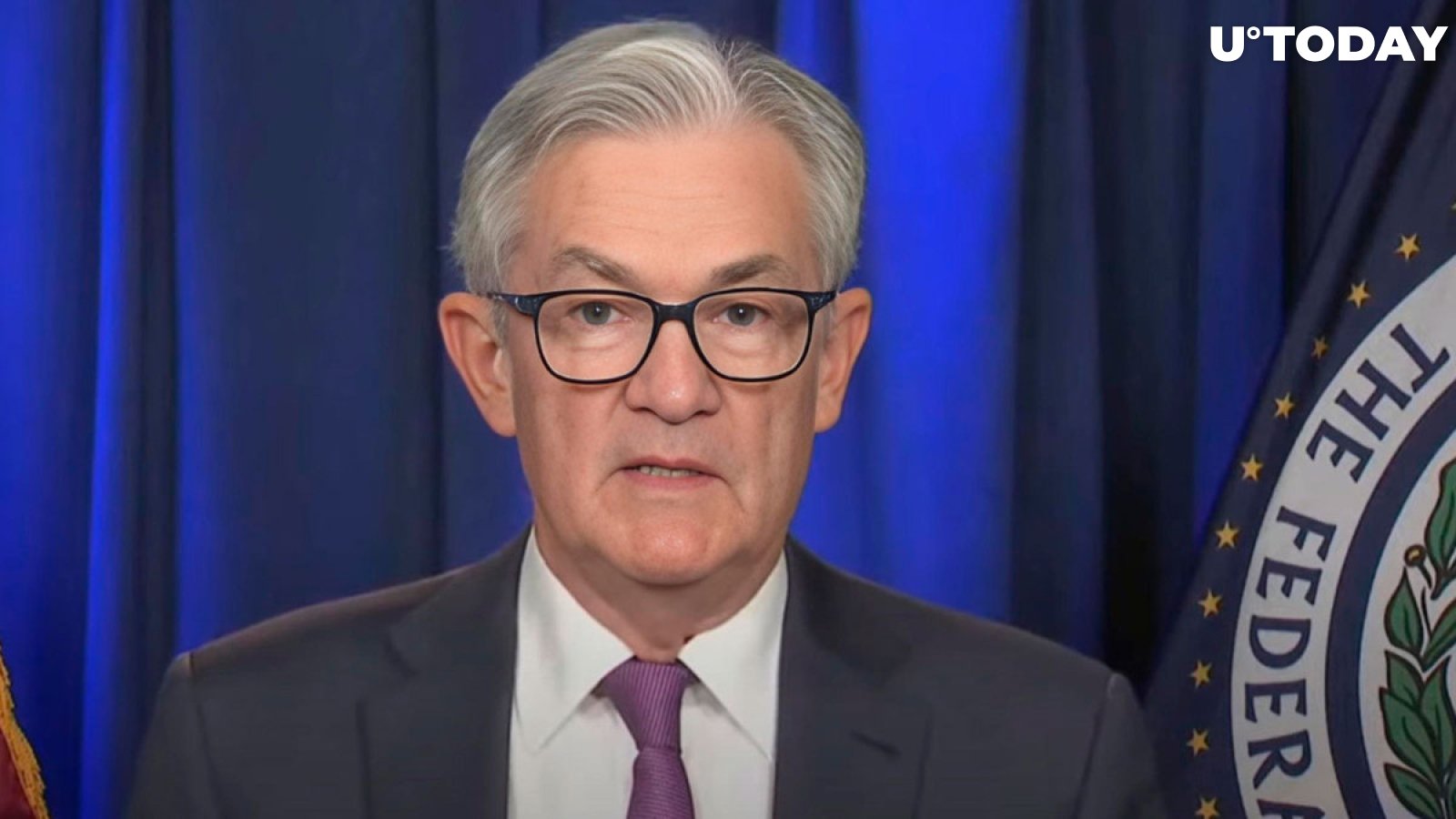

Federal Reserve Chair Jerome Powell's recent comments have stirred quite a discussion, not just on the traditional financial markets but also within the crypto ecosystem. In an unforeseen address, Powell suggested the potential for the central bank to pause its extended series of interest rate hikes, contingent on the continuation of recent progress on inflation. While his insights were primarily directed at long-term Treasury yields, the implications for the cryptocurrency market, including Bitcoin and other digital assets, are noteworthy.

The sentiment on traditional financial markets often has a ripple effect on the crypto market. When traditional markets are expected to perform well or show stability, institutional investors are sometimes more inclined to diversify their portfolios and explore riskier assets, such as cryptocurrencies. Powell's indication of a potential pause in interest rate hikes can be seen as a stabilizing factor for traditional markets. If these markets respond positively, we might witness an inflow of funds into the crypto sector as a diversification strategy.

With Powell's suggestion of maintaining current interest rates, there is a possibility of a lower yield on traditional financial instruments. This could bolster Bitcoin's attractiveness as a store of value, prompting both retail and institutional investors to allocate more funds into Bitcoin.

The decentralized finance (DeFi) sector within the crypto ecosystem is particularly sensitive to interest rate changes. DeFi platforms offer yield farming and staking opportunities that can sometimes provide returns far exceeding traditional instruments. If the Fed holds interest rates steady, the yield disparity between traditional financial products and DeFi could widen.

The broader uncertainty surrounding global economic conditions, inflation rates and central bank policies often acts as a catalyst for investors to diversify their portfolios. Cryptocurrencies, being noncorrelated assets, serve as a natural choice for portfolio diversification.

Vladislav Sopov

Vladislav Sopov