Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Staked Ethereum token by Lido Finance remains a popular tool among Ethereum stakers that are willing to be more liquid on the market by using the token issued in relation to stacked coins. During periods of high volatility, stETH's price against ETH might tumble below certain thresholds, which some investors use as an arbitrage opportunity.

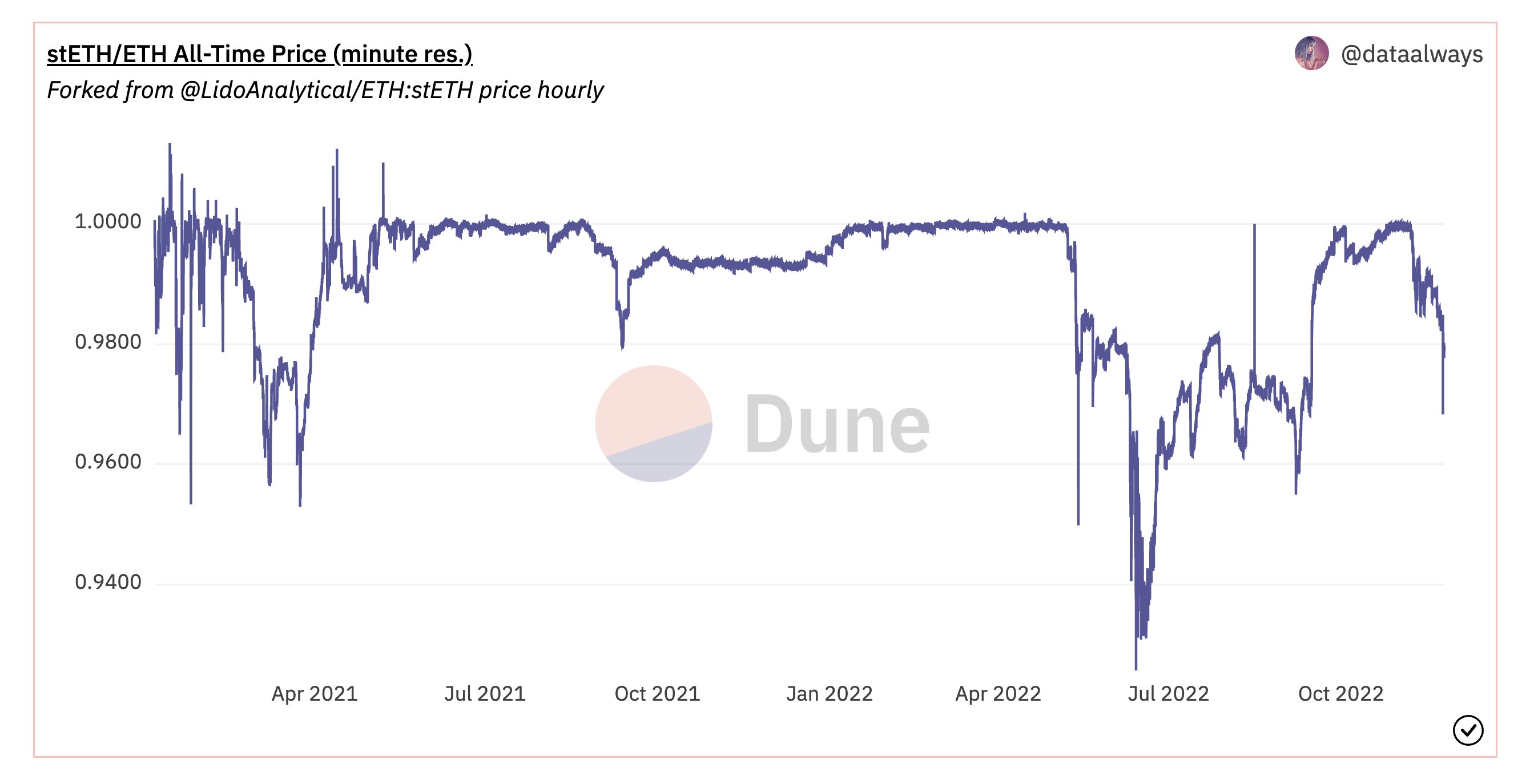

According to market data, stETH has once again rolled at a discount against ETH, with its value reaching 0.97, which puts it at a 3% discount against the "real Ethereum." Investors have not seen stETH at such a low level since UST's implosion.

Meanwhile, the share of Ethereum on the stETH/ETH curve pool has reached 69%, which might be a sign of the stabilization of the pair in the future. However, every arbitrage opportunity on the market brings significant risks to traders.

The decoupling of stETH is an unhealthy sign for every Lido DAO participant. The most likely reason behind the decoupling might be tied to the most recent dispute in the Ethereum validator community caused by yet another postponement in the staked ETH unlocking timeline.

At this point, it is not clear when users will be able to get their Ethereum back from locked contracts. While tokens like stETH increase the liquidity of the staked Ethereum, the inability of users to manage their funds freely is a serious problem that might become fuel for a massive selling pressure spike in the future.

Ethereum critics previously warned investors that unclear lock-up terms could cause an enormous spike in selling activities after investors get their ETH back, and no burning mechanism will prevent holders in a panic from potentially crashing the value of the second-biggest cryptocurrency on the market.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov