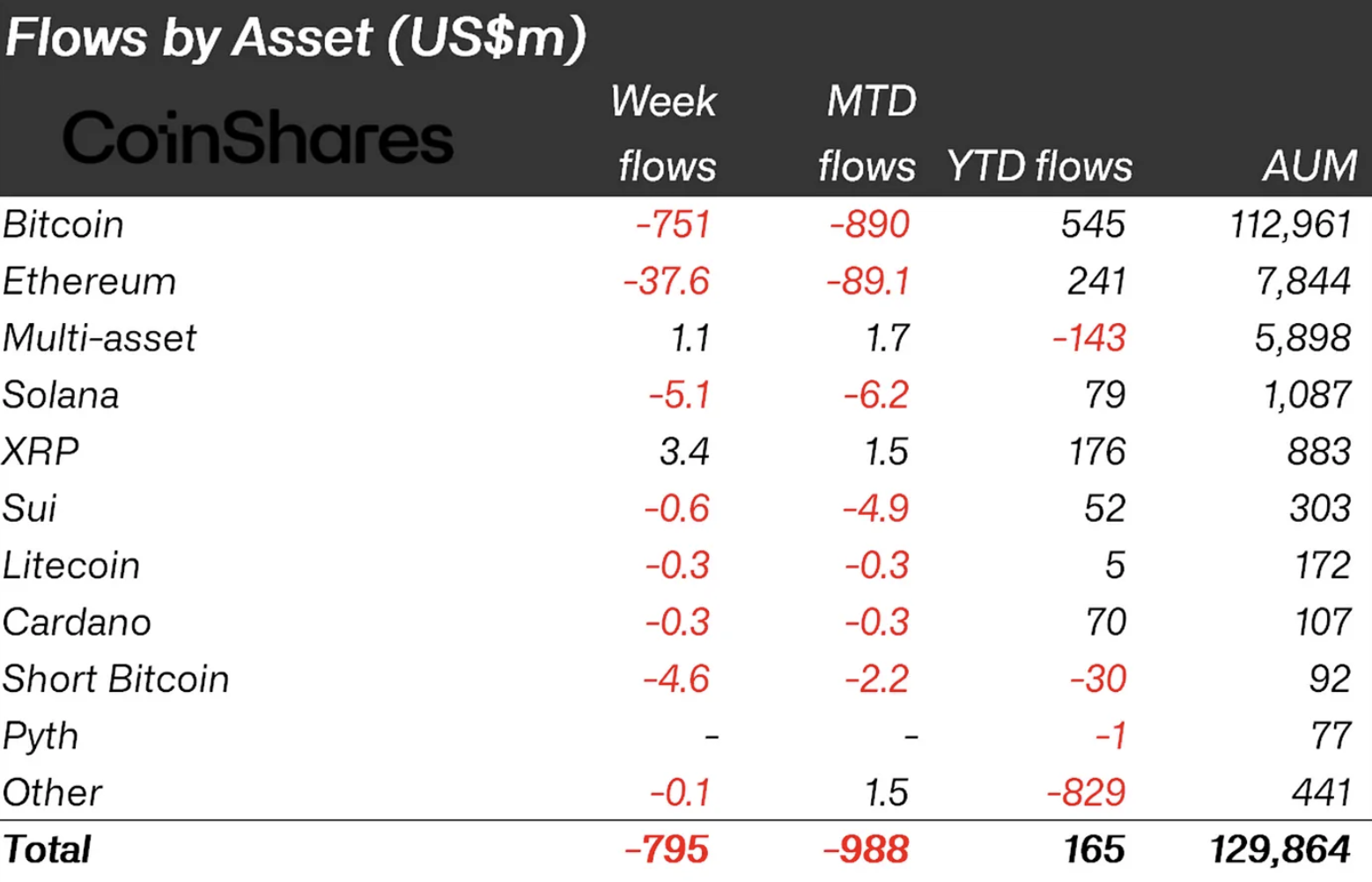

While the digital asset investment space continued to lose capital for the third week in a row, posting $795 million in outflows and dragging the month-to-date figure close to the billion mark, a few assets managed to reject the trend — and right at the top of that short list was XRP, which attracted $3.4 million in inflows while almost everything else went the other way.

That kind of divergence does not usually show up so clearly, especially in a week like this where negative sentiment is more or less everywhere at once.

Flows were down across countries, down across providers and down across pretty much every major asset except a handful of small altcoins — but XRP not only avoided the hit, it led all non-Bitcoin tokens in net inflows, as reported by CoinShares.

In a week that saw the United States pull $763 million out of crypto ETPs alone, that stands out.

The larger market narrative has not changed much. Since early February, when outflows really picked up, the sector has seen $7.2 billion pulled out, which has now wiped out nearly all of the net gains made earlier in the year, bringing year-to-date flows to just $165 million.

Bitcoin (BTC) again saw the most pressure with $751 million in outflows, followed by Ethereum with $37.6 million. Solana (SOL), Sui and Litecoin did not fare much better, all posting losses and even short Bitcoin saw outflows — suggesting bearish bets were being unwound as well.

Still, despite the pressure, the total amount of assets under management actually rose — not due to inflows but thanks to a price rebound toward the end of the week after the temporary tariff rollback gave the market some breathing room, pushing the figure back up to $130 billion.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov