New analytical resource GBTC Bitcoin Tracker is focused on the most overhyped Bitcoin-based ETF-like product, Grayscale Bitcoin Trust (GBTC). It seems that Grayscale is back to buying after the holidays with increased aggression.

2,612 Bitcoins (BTC) added by Grayscale in 24 days. How many BTC were mined?

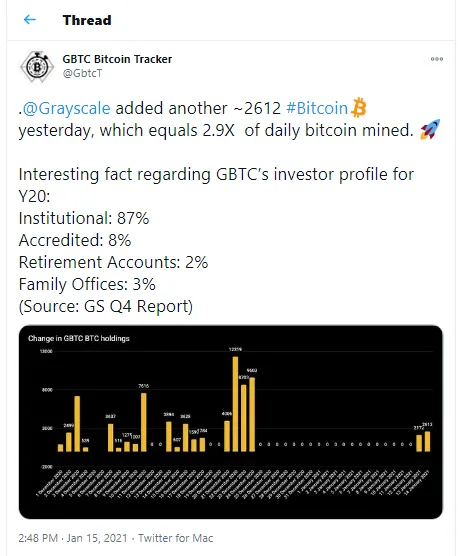

According to a recent tweet posted by GBTC Bitcoin Tracker, Grayscale Bitcoin Trust added another 2,612 Bitcoins (BTC) overnight. In the corresponding period, all Bitcoin (BTC) miners active in the network received almost three times fewer Bitcoins (BTC).

With this addition, Grayscale Bitcoin Trust (GBTC) now has $23.453 billion in net assets under management. It is the largest allocation for Grayscale.

The closest competitor, Grayscale Ethereum Trust (ETHE), holds $3.43 billion in AUM. Also, the company offers products based on Ethereum Classic (ETC), Bitcoin Cash (BCH), Horizen (ZEN), Litecoin (LTC), Stellar Lumens (XLM) and ZCash (ZEC).

As covered by U.Today previously, Grayscale Investments decided to remove XRP Trust from its product line amidst Ripple's legal battles with the U.S. SEC.

87 percent of Grayscale Bitcoin Trust funds are from institutions

Yesterday, on Jan. 14, 2021, Grayscale Investments released its much-anticipated Q420 report, the first one that covers the ongoing crypto rally. It has been disclosed that 87 percent of Grayscale Bitcoin Trust customers represent institutional demand.

Eight percent of GBTC holders are accredited private investors while retirement accounts and family offices are responsible for five percent of GBTC money combined.

Grayscale Trusts are avaliable on "over-the-counter" desks. They allow investors to gain exposure to crypto price dynamics with no need to obtain digital assets on-chain.

Also, today it was announced that another Bitcoin ETF-like product, QBTC by Canadian investment giant 3iQ, surpasses $1 billion in AUM for the first time in its history.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin