The first-ever regulated cryptocurrency-oriented ETF-like fund, Bitcoin Trust by Canadian giant 3iQ, has accomplished a historical milestone in terms of value.

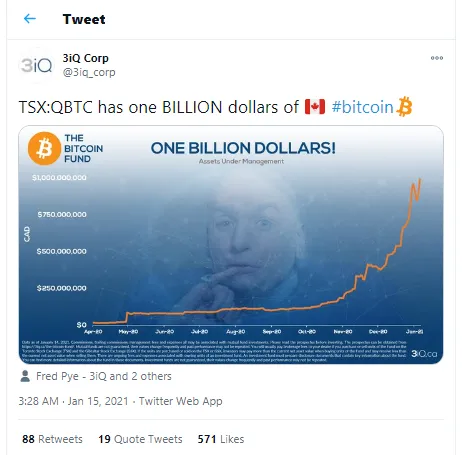

First billion dollars for Bitcoin (BTC) Fund

While Bitcoin (BTC) revisited the $40,000 level for the first time after a painful 26 percent drop, Canada-based investment corporation 3iQ reports that its flagship product, Bitcoin Trust, has reached $1,000,000,000 in total volume of assets under management.

This achievement was mentioned in a celebratory tweet by the 3iQ team. It should be noted that the price of one share of this fund rocketed hand-in-hand with the Bitcoin (BTC) price rally.

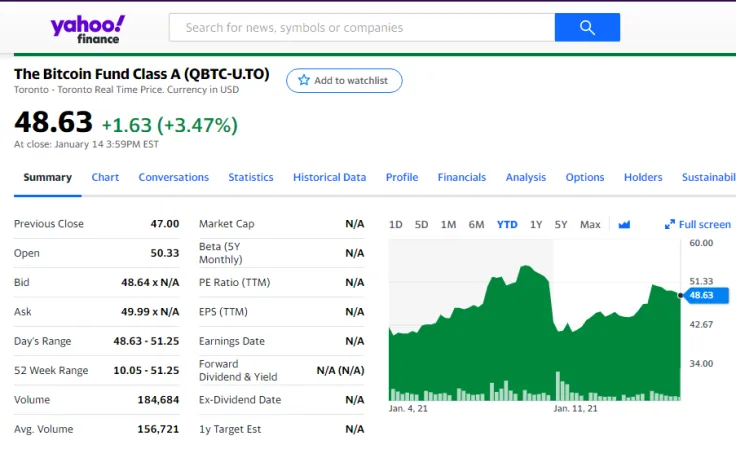

On Jan. 8, it reached an all-time high at $54.67. When Bitcoin (BTC) plummeted to $30,500, the price of QBTC also nosedived by 24.5 percent. Meanwhile, it restored promptly and is also in the green zone today, sitting at $48.63, or up 3.47 percent in 24 hours.

Bitcoin Trust by 3iQ was the first regulated Bitcoin-based investment product. Such assets provide retail and sophisticated investors with the opportunity to gain exposure to crypto markets without the necessity of buying and storing tokens directly.

Not only Bitcoin (BTC)

Bitcoin Trust by 3iQ is avaliable on the Toronto and Gibraltar stock exchanges—TSX and GSX, respectively—for clients with KYC/AML checks.

Also, 3iQ Ethereum Trust was listed as TSX:QETH.U on Dec. 11, 2020. It is one of the first Ethereum-based products for stock investors.

As covered by U.Today previously, Gemini Custody was the technical partner of QETH.U listing. The service provided by the Winklevii is responsible for the security of digital assets allocated by 3iQ investment corporation.

At press time, it is changing hands at $23.80, or up more than 100 percent from its IPO price ($11.80).

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin