Barry Silbert's Grayscale Investments has announced that the total amount of crypto it holds for its clients now equals more than an eye-popping $23 billion.

It has added $3.3 billion is less than a week.

Grayscale adds $3.3 billion, now holds $19.5 billion in Bitcoin

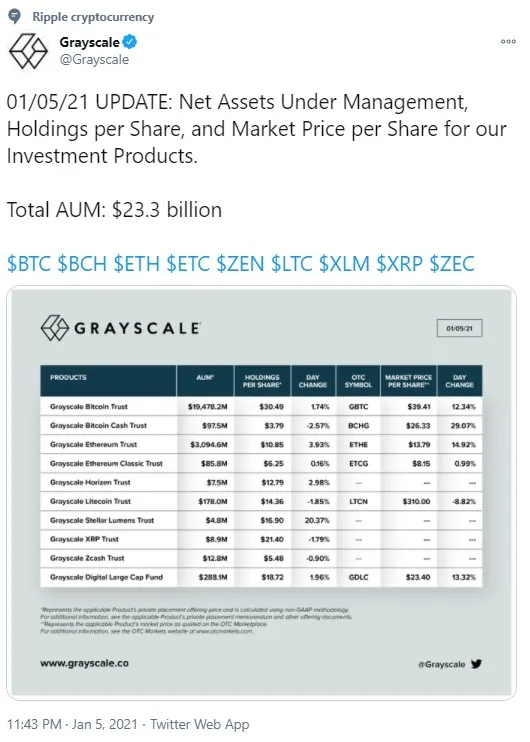

On Jan. 5, Grayscale announced on Twitter that the overall amount of crypto assets under its management totaled a mammoth $23.3 billion.

On Jan. 1, the company spread the word that it had reached the level of $20 billion crypto assets under management, which means that it added a whopping $3.3 billion to its crypto stash in merely four days.

Grayscale conducts purchases of Bitcoin, Ethereum and other digital assets constantly, although in December it announced that it had suspended cash inflows from investors. Still, data showed that Grayscale customers are still hungry for Bitcoin.

Recently, major Bitcoin critic and head of Euro Pacific Capital, Peter Schiff, referred to Grayscale as the biggest Bitcoin buyer, sharing his negative forecast for the company's BTC acquisition in the future.

Grayscale offers its clients exposure to ten crypto-based products, with Grayscale Bitcoin Trust (GBTC) being the most popular with investors. Total Bitcoin inflows now represent $19.5 billion.

As for the second most popular coin both on the market and with the company, the company holds $97.5 million in Ethereum.

Grayscale excludes XRP from its major fund

On the same day, Grayscale announced that, after a quarterly review, it had dropped Ripple's XRP token from its Digital Large Cap fund.

Now, the DLC fund is composed of only Bitcoin, Ethereum, Bitcoin Cash and Litecoin. Nothing was said about eliminating Grayscale XRP Trust, though.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin