It was a terrific year for Barry Silbert's Grayscale Investments.

The leading cryptocurrency money manager posted an update about reaching $20 billion in assets under management right on the verge of 2021.

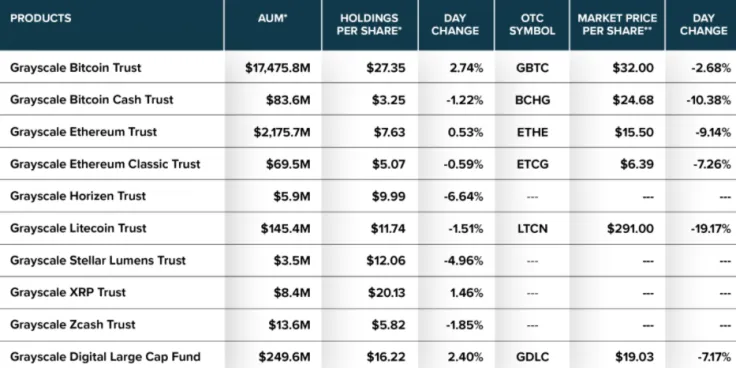

The firm allows its clients to get exposure to cryptocurrencies via a family of ten products. The Grayscale Bitcoin Trust (GBTC) accounts for the vast majority of all inflows with a total of $17.5 billion. Its similar offerings for Ethereum comes in a distant second place with $2.17 billion.

Both of its two biggest trusts are U.S. Securities and Exchange Commission reporting companies.

Earlier this weeks, there were numerous reports about Grayscale allegedly dumping its XRP holdings following SEC's lawsuit against Ripple. In reality, the decline in the dollar value of its position was actually attributed to the token's 73 percent rout over the past two weeks.

However, Bitwise, another top crypto asset manager, was quick to liquidate $9.3 million worth of XRP right after the SEC sued Ripple.

10x growth

Grayscale only had $2 billion in assets under management a year ago, as noted by Silbert in a celebratory tweet.

It took the firm — whose clients are mainly institutional investors — less than two months to go from $10 billion in mid-November to $20 billion by the end of December.

Earlier this month, JPMorgan's strategists warned that a major slowdown in inflows could spell trouble for Bitcoin's bull run, but institutional interest in Bitcoin seems to be not even close to waning.

In the meantime, $49 billion investment management firm VanEck has once again filed papers with the SEC in at attempt to gets its Bitcoin ETF proposal approved.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin