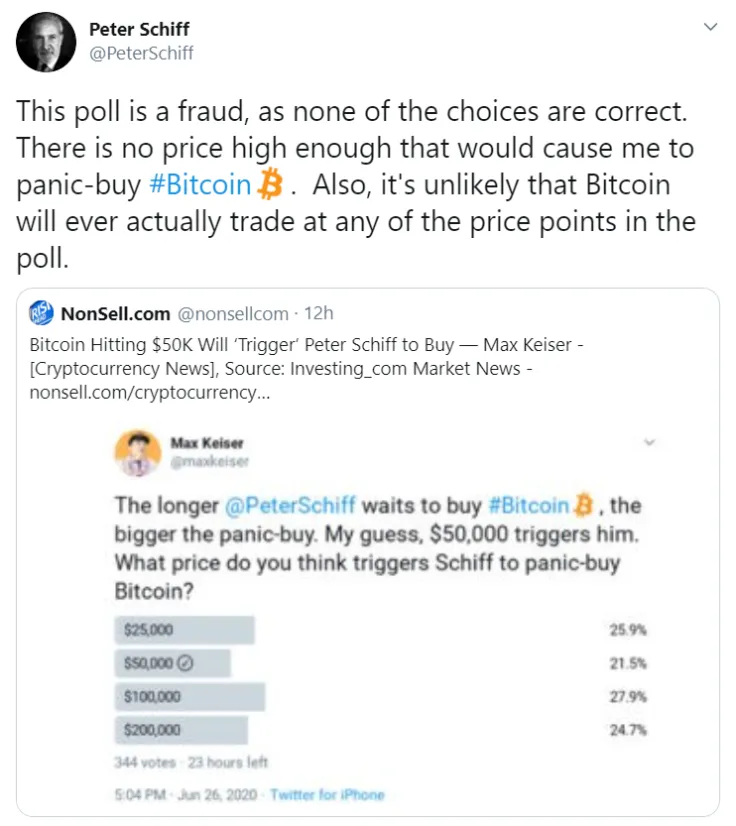

Peter Schiff, the CEO of Euro Pacific Capital who’s known for his unpopular bearish views on Bitcoin, is convinced that the flagship cryptocurrency is never touching $25,000, according to his recent tweet.

This is the lowest price point posted by in a poll RT host Max Keiser that is meant to determine when the ferocious gold bug will eventually FOMO-buy Bitcoin.

Schiff doesn’t learn from his mistakes

Schiff, who has been dismissive of Bitcoin since 2011, has famously missed out on the best-performing asset of the previous decade.

While he did own up to the mistake, claiming that he shouldn’t have purchased Bitcoin when he first learned about it, he now routinely urges hodlers to liquidate their holdings and take profit while they still can.

Schiff has been trying to fearmonger about Bitcoin since the Cyprus crisis, which sent the BTC price through the roof in 2013, to cajole its owners into buying precious metals, but most of these attempts have so far backfired.

Euro Pacific Capital even started accepting Bitcoin back in 2014 after partnering with BitPay.

Riding it to zero

Fast-forward to 2020, Schiff now claims that Bitcoin is a fraud that would refuse to touch at any price.

He also came up with his own poll to get back at Keiser who was one of the earliest Bitcoin evangelists.

Most responders believe that Keiser will ride Bitcoin all the way to zero, which seems plausible to Schiff who is certain that the top cryptocurrency has unlimited downside risk.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov