Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Decentralized exchanges (DEXes) on Ethereum are dominating the market. The volume of DEXes, like Uniswap, is continuing to increase as fees spent on ETH deposits to exchanges drop.

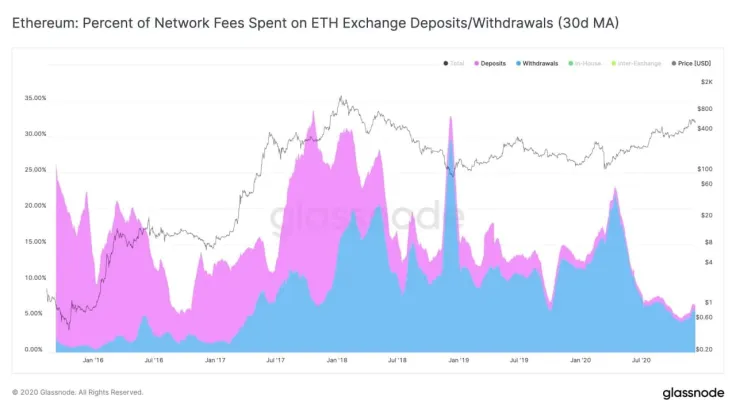

It is possible to gauge the declining activity of Ethereum users on centralized exchanges due to gas costs.

On the Ethereum blockchain network, when a user sends a transaction, the user needs to pay transaction fees in the form of gas. If the amount of ETH fees linked to centralized exchanges falls steeply, it could indicate an overall decrease in Ethereum user activity on centralized exchanges.

It is indicative of Ethereum and DeFi momentum

Analysts at Glassnode found that the Ethereum fees spent on centralized exchange deposits dropped from 25 percent three years ago to 1 percent. They said:

“From #CeFi to #DeFi in one picture. The amount of fees on #Ethereum spent on $ETH deposits to centralized exchanges has fallen from ~25% in 2017 to less than 1% today. Almost all fees spent on txs involving centralized exchanges in the past months were used for ETH withdrawals.”

Advertisement

One of the main reasons why major DEXes have been able to surpass some large centralized exchanges by volume is usability and liquidity.

In the past two years, it was less compelling for users to rely on decentralized exchanges. DeFi cycles were not developed to the scale they are now, and there was not enough interest in newly emerging DeFi projects.

Most importantly, decentralized exchanges are as liquid as many of the top centralized exchanges. This means that traders can trade large amounts of cryptocurrencies without major slippage and liquidity insufficiency.

For instance, as of Dec. 12, Uniswap has $1.6 billion in liquidity and $246 million in daily trading volume.

Are centralized exchanges pushing Bitcoin as a result?

Some Ethereum users have speculated that centralized exchanges might be pushing Bitcoin to users as ETH and DeFi users flock to decentralized exchanges.

Hayden Adams, the creator of Uniswap, acknowledged this point and said it is a logical speculation. He said:

“This is a really good point. Ethereum / ERC20s is mainly used in decentralized platforms (dapps) - see @UniswapProtocol beating CEX Bitcoin doesn't have smart contracts so is mainly used in centralized platforms for anything other than payments.”

According to Crypto Fees, Uniswap is processing over $880,000 in Ethereum network fees per day. This is merely $400,000 away from the Bitcoin network’s daily fees of around $1.285 million.

On top of this, the broader DEX market is gaining a larger share of the global cryptocurrency exchange market on a daily basis. CoinGecko CEO Bobby Ong noted:

“Amongst DEXes, @SushiSwap saw strong growth and now commands 11% of the top 7 DEX market share. @UniswapProtocol still maintains a very strong lead despite the vampire mining attack of Sushiswap. However, overall DEX volume went down 3.3 billion month-on-month.”

Dan Burgin

Dan Burgin Alex Dovbnya

Alex Dovbnya Denys Serhiichuk

Denys Serhiichuk