Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

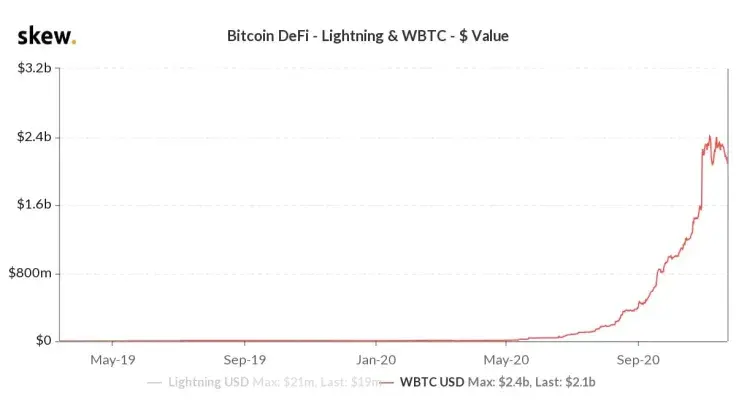

The decentralized finance (DeFi) market has seen explosive growth in 2020. Various metrics, such as the total value locked (TVL), shows the sector's parabolic expansion in recent months. But arguably the most optimistic trend is the increase in the number of Wrapped Bitcoin (WBTC).

Wrapped Bitcoin is an ERC20 token that reflects the value of BTC. The token was created by top DeFi protocols in January, which include MakerDAO, Kyber Network and Compound.

Why is the rising popularity of Wrapped Bitcoin an optimistic sign for DeFi?

Since Bitcoin and Ethereum are two different blockchain networks, it is not possible to directly send BTC to the Ethereum network. As such, when investors want exposure to DeFi services with BTC, they typically convert BTC to Wrapped Bitcoin.

The growing popularity and usage of WBTC in the DeFi market indicates two trends. First, it shows that Bitcoin holders are increasingly leveraging DeFi protocols and services. Second, it is indicative of the confidence of investors in DeFi.

According to CoinMarketCap, over $2 billion worth of WBTC has been minted to date. Currently, as of Dec. 11, this means that there is more than $2 billion in BTC on DeFi protocols.

The benefit of WBTC is that it allows Bitcoin investors to maintain exposure to the BTC price while using DeFi services in tandem. The fact that such a large number of BTC is locked in DeFi shows that investors are more confident with DeFi in general.

In the past, when the DeFi space was still in a nascent growth phase, there were many instances of hacks, smart contract failures and bugs. The instability of small DeFi protocols made it difficult for Bitcoin investors to use and leverage DeFi services.

In recent months, the new DeFi cycle has produced key players such as Compound, Yearn.finance and Aave, making DeFi services more reliable and stable than before.

What's next for DeFi?

With total value locked in DeFi hitting $15 billion this week, the DeFi space is still seeing a parabolic uptrend.

An argument could be made that the new phase of DeFi is just beginning due to the rapid increase in decentralized exchange volume.

Leading decentralized exchanges, like Uniswap, are processing around $300 million in daily volume on average. There have been a large influx of active users who utilize DeFi on a daily basis on a larger scale.

Alongside Uniswap, other decentralized exchanges and automated market makers (AMMs), such as SushiSwap, have also recorded a massive spike in daily volume.

If the trend of decentralized applications seeing higher user activity continues, the next DeFi cycle could potentially see the total value locked in DeFi increase exponentially.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov