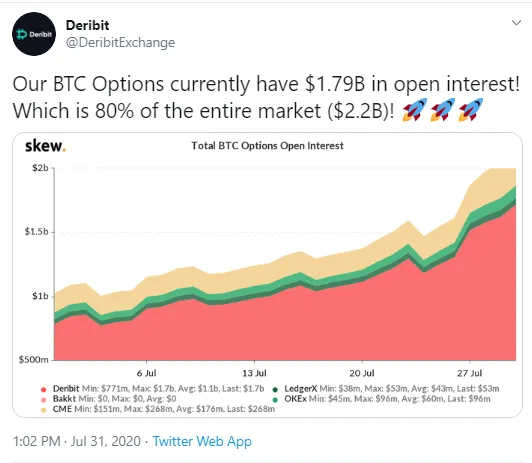

Deribit exchange has tweeted that at the moment its open interest (OI) for Bitcoin options totals $1.79 bln.

Meanwhile, Skew analytics agency reported that 68,000 Bitcoin options are expected to expire today.

Deribit BTC options OI approaches $2 bln

The Deribit exchange has been leading in the volume of OI for Bitcoin options, according to the chart published in its recent tweet.

The BTC options OI here totals $1.79 bln—equal to eighty percent of the whole market—whereas another large platform for trading crypto derivatives, CME Group, has shown a much smaller figure: $268 mln.

The maximum OI volume on OKEx is slightly below $100 mln. As for LedgerX, it is under $50 mln, and it is zero so far for Bakkt, as per the chart.

These figures, and the one shown by Deribit in particular, signify that interest in Bitcoin from both institutional and retail investors is quite high and continues to grow.

Meanwhile, as per Skew, analysts expect Bitcoin options worth 67,700 BTC to expire today.

An amount bigger than that could signify a splash of volatility for BTC, as it is not clear how many put or call options would be expiring. However, experts are not certain whether the expiration of 68,000 BTC options will shake the market or not have any impact at all.

260,000 ETH options about to expire

Skew has also shared a chart, according to which 260,000 Ethereum options are going to expire on Friday.

Options (calls and puts) are derivatives that enable a trader to deal with assets on a certain date in the future at a price agreed on beforehand.

Bulls use call options and bears work with puts. Large amounts of expiring options may impact the price of an asset if analysts know whether the majority of options that are expiring are calls or puts.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin