Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

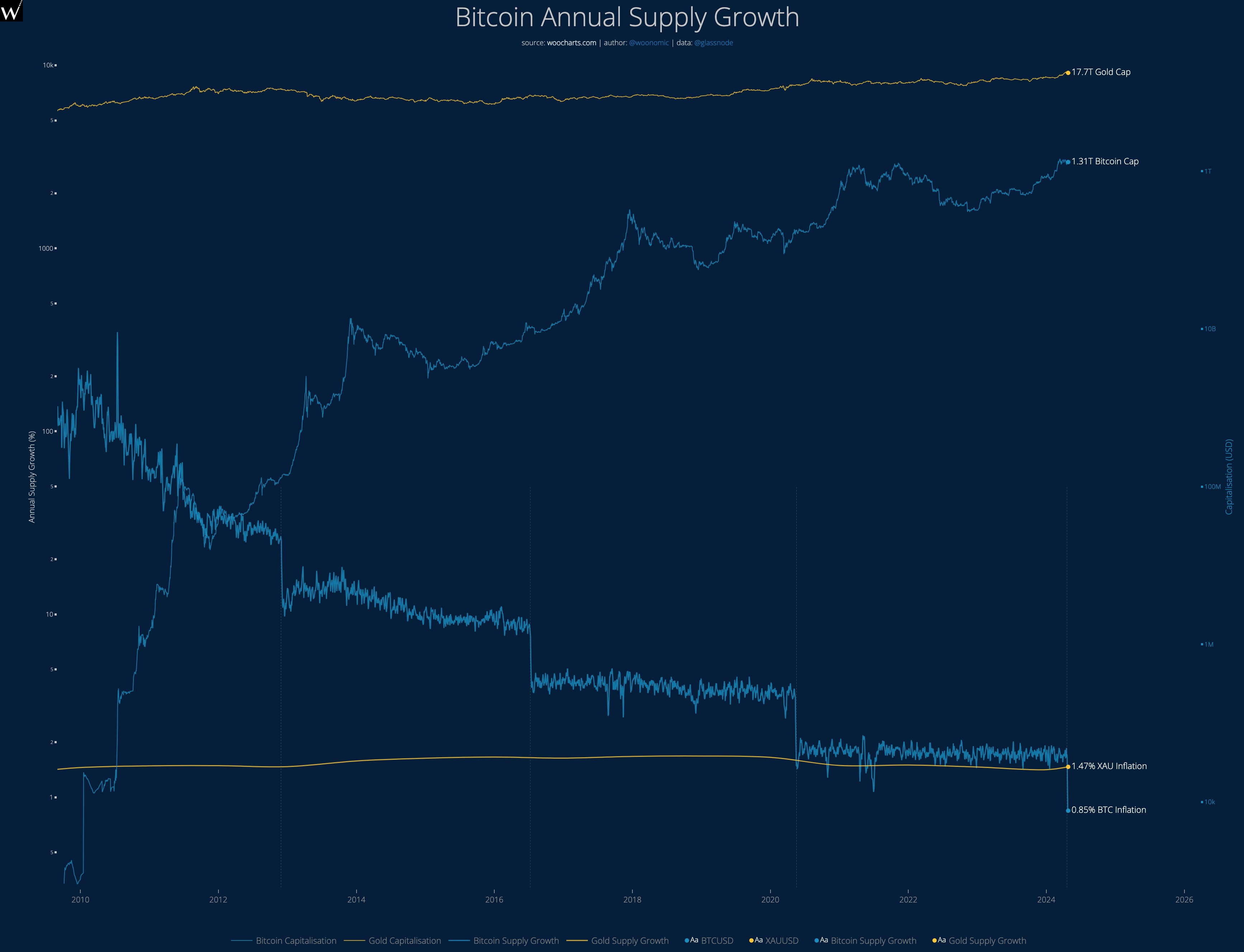

Bitcoin analyst Willy Woo recently initiated a discourse within the cryptocurrency community concerning the feasibility of Bitcoin surpassing gold's market capitalization of $17.7 trillion. In a series of insightful remarks, the expert delved into the nuanced dynamics of stock-to-flow (S2F) ratio, inflationary trajectory of BTC and the evolving landscape of institutional adoption.

Central to Woo's thesis is the S2F model, a metric that gauges an asset's scarcity by comparing its existing supply to its annual production. With Bitcoin's inflation rate now lower than that of gold, the expert posits that the cryptocurrency stands poised to challenge the dominance of the precious metal in the realm of store-of-value assets.

However, Woo tempered expectations by suggesting a potential lag of 5 to 10 years before Bitcoin's market capitalization aligns with its S2F valuation. He attributed this delay to various factors, including the gradual integration of Bitcoin into institutional portfolios, the development of regulatory frameworks and the establishment of custody solutions.

People's money

Despite this cautious prognosis, Woo underscored the potential for retail investors capable of self-custodying their Bitcoin holdings to experience the benefits of the S2F model sooner. He hinted at a divergence between institutional and retail adoption timelines, suggesting that the latter may embrace Bitcoin's value proposition more rapidly.

As there is a possibility for Bitcoin's market cap to reach $17 trillion, questions linger about the potential implications for cryptocurrency's price dynamics in the interim.

Could the perceived lag between Bitcoin's intrinsic value and its market capitalization lead to increased volatility or speculative trading patterns? And how might external factors such as regulatory developments and macroeconomic trends influence its trajectory relative to gold?

Arman Shirinyan

Arman Shirinyan Alex Dovbnya

Alex Dovbnya Denys Serhiichuk

Denys Serhiichuk