Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

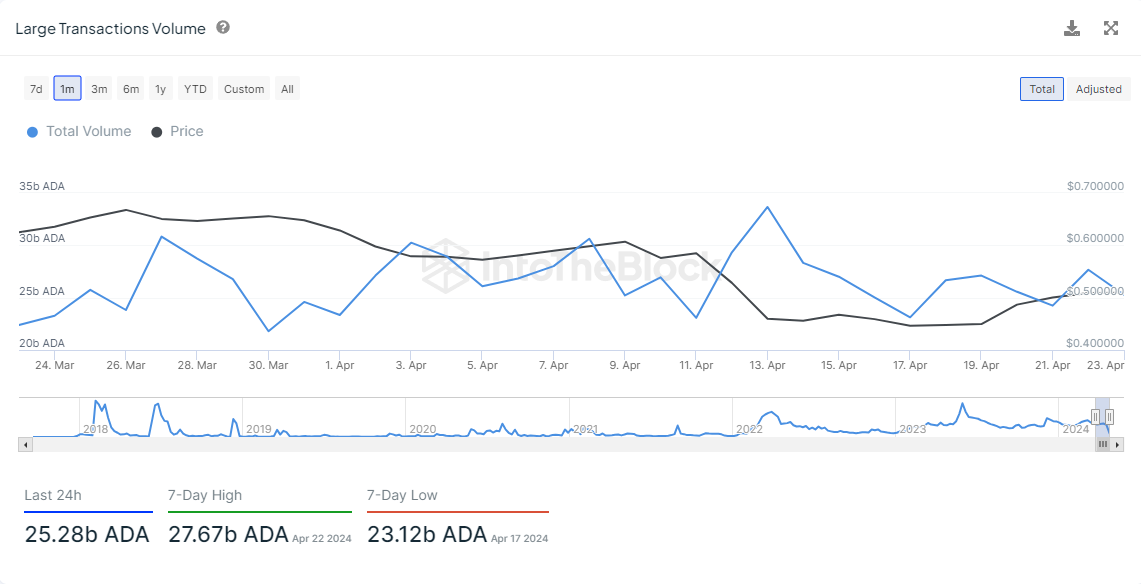

ADA has witnessed a surge in activity, with the number of large transactions skyrocketing. A staggering 25 billion ADA were transferred within a 24-hour period. The activity spotted on-chain aligns with ADA's price action and demands a deeper look into the on-chain metrics and their implications for the asset's future.

Delving into the on-chain data, we see a notable spike in the number of large transactions, which often signify substantial wallet movements by whales or institutional players. Such movements can suggest preparation for market developments, bullish or bearish. Furthermore, the large transaction volume, peaking at 27.67 billion ADA recently, reinforces the intensity of this activity.

Simultaneously, ADA's price chart displays a tension-filled narrative. After a period of decline, ADA shows attempts at recovery, flirting with the 50-day EMA, currently at around $0.5, yet unable to achieve a clear breakthrough.

With ADA currently trading just below this critical EMA level, the focus is on whether it can gain the necessary momentum to surpass it. If ADA succeeds, it could encounter the next resistance at approximately $0.55, an ascent that would align with the increased on-chain activity. Conversely, failure to move past the 50 EMA may see ADA retest the support near $0.49, a recent low that might serve as a staging ground for another upward attempt.

Given the current dynamics, the future for ADA depends on the on-chain activity and the surge of buying activity on the market. Unfortunately, the market is currently taking a break before moving upwards again. Hopefully, the drop of liquidity and volatility on the market closer to the weekend will not lead to a substantial price drop.

Arman Shirinyan

Arman Shirinyan Alex Dovbnya

Alex Dovbnya Denys Serhiichuk

Denys Serhiichuk