Blockchain sleuth Chainalysis has revealed that about $2.8 bln worth of Bitcoin (BTC) obtained by criminals was cashed out in 2019 with the help of over-the-counter (OTC) brokers. This is certainly some startling statistics for law enforcement agencies around the globe that are vying to clamp down on crypto-related money laundering.

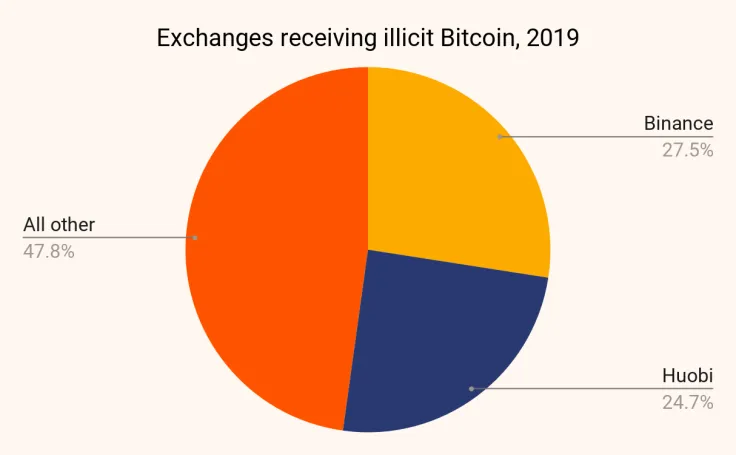

Notably, Binance and Huobi are responsible for processing more than half of all illicit transactions.

OTC desks serve as an important intermediary

OTC brokers come in handy because of their high-volume supply, allowing customers to buy or sell large amounts of crypto. In fact, according to some estimates, centralized exchanges are responsible for only a fraction of the total trading volume but it's pretty much impossible to estimate how many coins are changing hands over the counter.

While there are plenty of legitimate OTC desks that are operated by such high-profile exchanges like Сoinbase and Kraken, this market niche is also filled with plenty of bad actors who take advantage of relatively loose regulations.

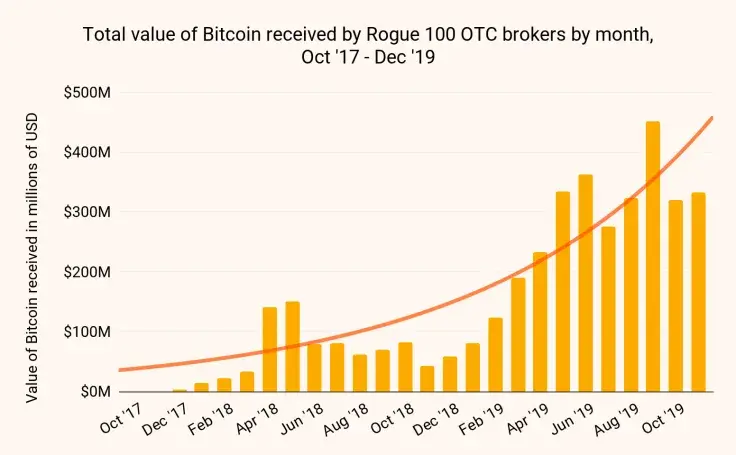

Those OTC brokers that facilitate illegal activities are collectively named a "Rogue 100" group. They control a pool of Bitcoin wallets and offer criminals an easy way to convert their ill-gotten coins.

"The Rogue 100 are extremely active traders and have a huge impact on the cryptocurrency ecosystem. They’ve received steadily increasing amounts of cryptocurrency each month since late 2017, but their activity skyrocketed this year."

Advertisement

The firm adds that Rogue 100 could be responsible for one percent of all Bitcoin activity.

Binance and Huobi offer a helping hand

Chainalysis has estimated that 70 percent of all brokers operate on Singapore-based centralized exchange Huobi. Less important players outside of crypto also rely on Binance, the biggest exchange by trading volume, for turning Bitcoin into cash.

It's important to note that the Rogue 100 group doesn't necessarily cover the whole scope of illicit transactions that are happening on Binance and Huobi.

"We think it’s extremely likely that some percentage of the other highly-active Binance and Huobi accounts taking in illicit funds also belong to corrupt OTC brokers we’ve yet to identify."

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov