Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

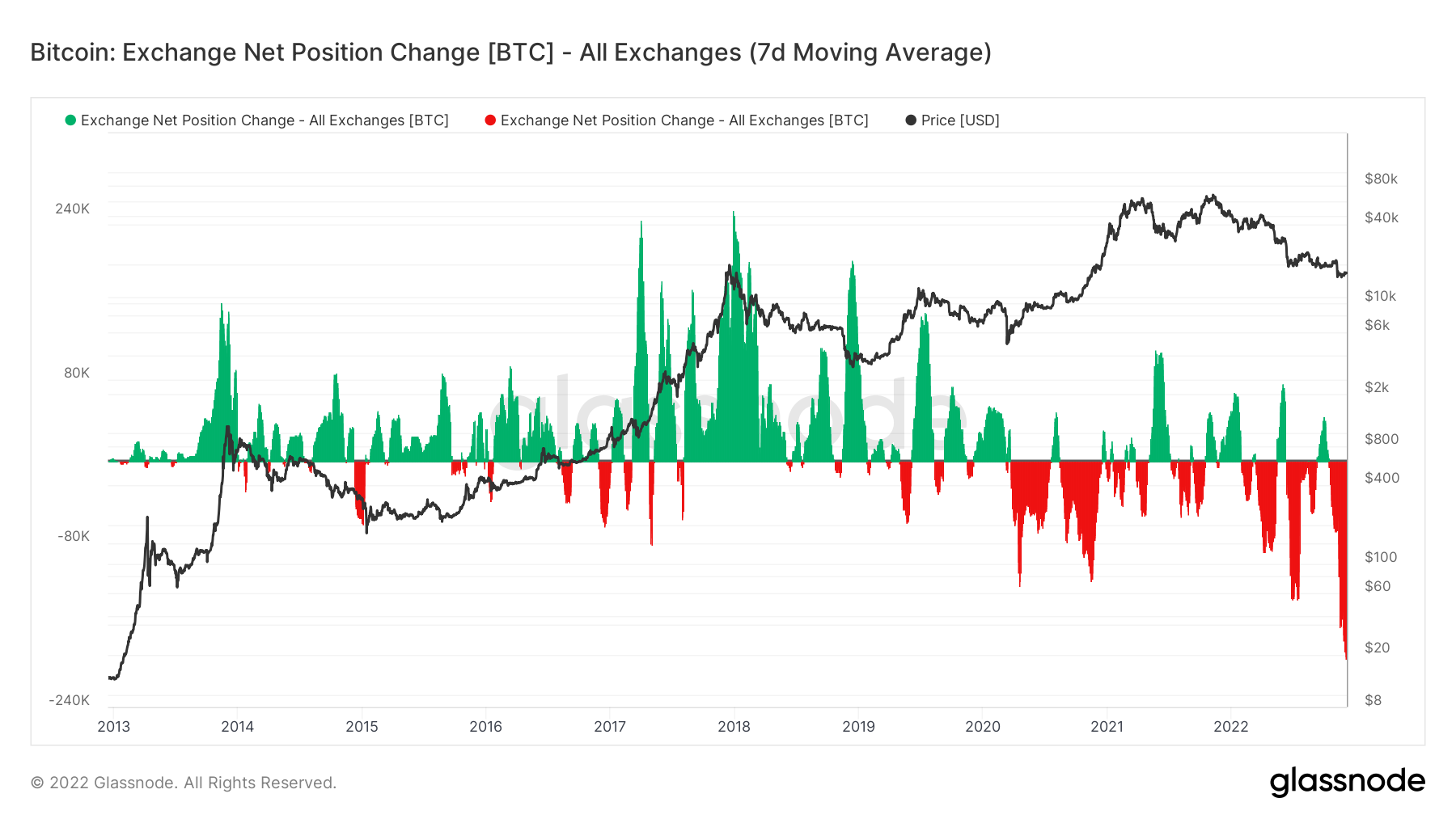

The great migration of cryptocurrencies off of exchanges continues: investors are rapidly closing most of their positions on trading platforms and transferring their funds to cold storage or hot wallets due to the crisis of trust emerging between exchanges and their users.

Cryptocurrency exchanges have been facing a real crisis after the implosion of FTX: unprecedented volumes of Bitcoin, Ethereum and other top-tier cryptocurrencies are leaving centralized trading platforms as investors are looking for ways to safeguard their holdings. The trend might persist on the market up until the end of the year.

According to on-chain data, around 200,000 BTC worth $3.4 billion and more than 1 million ETH left various centralized cryptocurrency trading platforms, which makes it the biggest migration of funds from CEXes since 2021. Such a tendency is an indicator of a number of things.

First, the decreasing amount of assets on exchanges quite often correlates with a descending trend in open interest and overall selling pressure on the market. Once traders move their funds away from the open market, they tend to hold them longer in comparison to those investors who store their funds on exchanges' wallets.

How does this affect market?

If the trend prevails, the selling pressure we witnessed back in November will descend, along with the volatility. The outflow of funds from exchanges usually heralds an accumulation stage, which comes right before the overall recovery of the market.

Despite the depression in the macroeconomic sector, the recovery of the cryptocurrency market is still possible, even without the rally on tradfi markets. However, making predictions and setting time frames is a complicated task to perform, especially by the end of the year.

Caroline Amosun

Caroline Amosun Godfrey Benjamin

Godfrey Benjamin Arman Shirinyan

Arman Shirinyan Gamza Khanzadaev

Gamza Khanzadaev Alex Dovbnya

Alex Dovbnya