Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

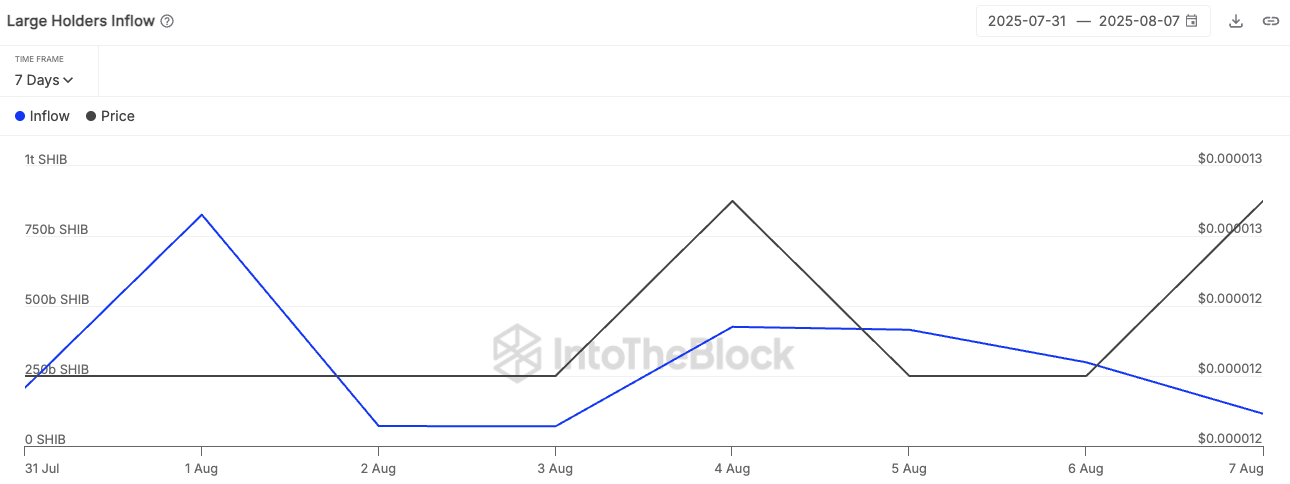

The start of August was a bit of a shocker: on the 1st, wallets holding over 0.1% of SHIB's supply got more than 750 billion tokens in one go, according to IntoTheBlock, which is enough to catch the eye of anyone keeping an eye on big-time holders. These spikes often show up near cycle lows, which makes us think that whales are getting ready for the next leg. But this time, the follow-through did not quite go to plan.

By Aug. 4, inflows were still a sizable 425.54 billion SHIB, with the price at $0.000013, but the tide was already turning.

Within a few days, inflows dropped off a lot to just over 115 billion tokens. But instead of stabilizing, SHIB's price chart went downhill fast, shedding around 73% of its early-month peak. This put a damper on the optimism that the whale spike had generated.

How is Shiba Inu's (SHIB) price?

The daily setup shows the token trying to hold on to the $0.0000129 area, with a stronger floor at around $0.00001107. If sellers keep pushing the market in this way, it could be a problem.

But if they do try to push higher, they will have to get past the resistance at $0.0000135 first, and then the mid-July high near $0.0000169 before the bulls can say they have turned the tide.

It is important to remember that not all big-time investors are just "strong hands buying the dip" moments. Some of them show tokens being shuffled for internal accounting, to settle between companies or to be put aside before exchange deposits.

With SHIB, the abnormal inflow wave did not lock in a rally; it preceded one of the sharper pullbacks in months, so it left open the question of whether this was opportunistic buying gone wrong or a warning that was hiding in plain sight.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin