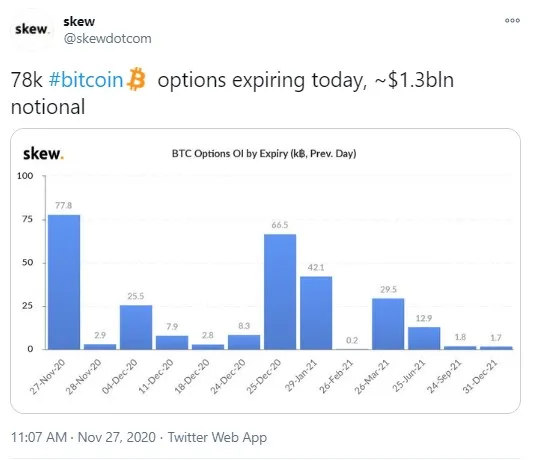

Skew analytics team has tweeted that, this Friday, a gigantic amount of BTC options is to expire, cumulatively worth roughly $1.3 billion or nearly 78,000 BTC.

Skew has also shared more data on Bitcoin derivatives and BTC spot trading, which states that things are going well for Bitcoin despite the recent 10 percent correction.

Almost 78,000 BTC in options to expire

Skew derivatives data provider has taken to Twitter to announce that the biggest lot of Bitcoin options until the end of the year will expire today with a notional value of $1.3 billion (77,800 BTC).

The second biggest BTC options expiration this year is expected on Christmas Day (Dec. 25) and will total 66,500 BTC.

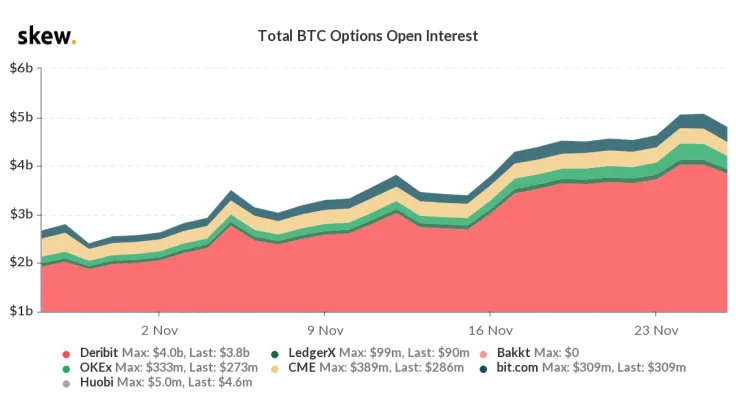

The cumulative open interest on Bitcoin options as of Nov. 26 totaled slightly under $5 billion, with the Dutch-based Deribit exchange taking the largest piece of that pie: $3.8 billion in OI.

One third of this amount of options is to expire later today. When large amounts of Bitcoin options expire, traders usually expect BTC volatility to strengthen.

CME becomes biggest BTC futures market

Skew has also spread the word that, judging by the latest data, CME has become the biggest BTC futures market for financial institutions.

The overall value of open interest on this type of BTC derivatives totals $1.16 billion compared to other exchanges, with OKEx ($1.07 billion) and Binance ($0.9 billion) being the second and third largest BTC futures platforms.

Such a massive rise in OI on BTC futures signifies high interest from institutional buyers.

Skew also reported that spot volumes of the BTC/USD pair exceeded $2 billion on Nov. 26.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin