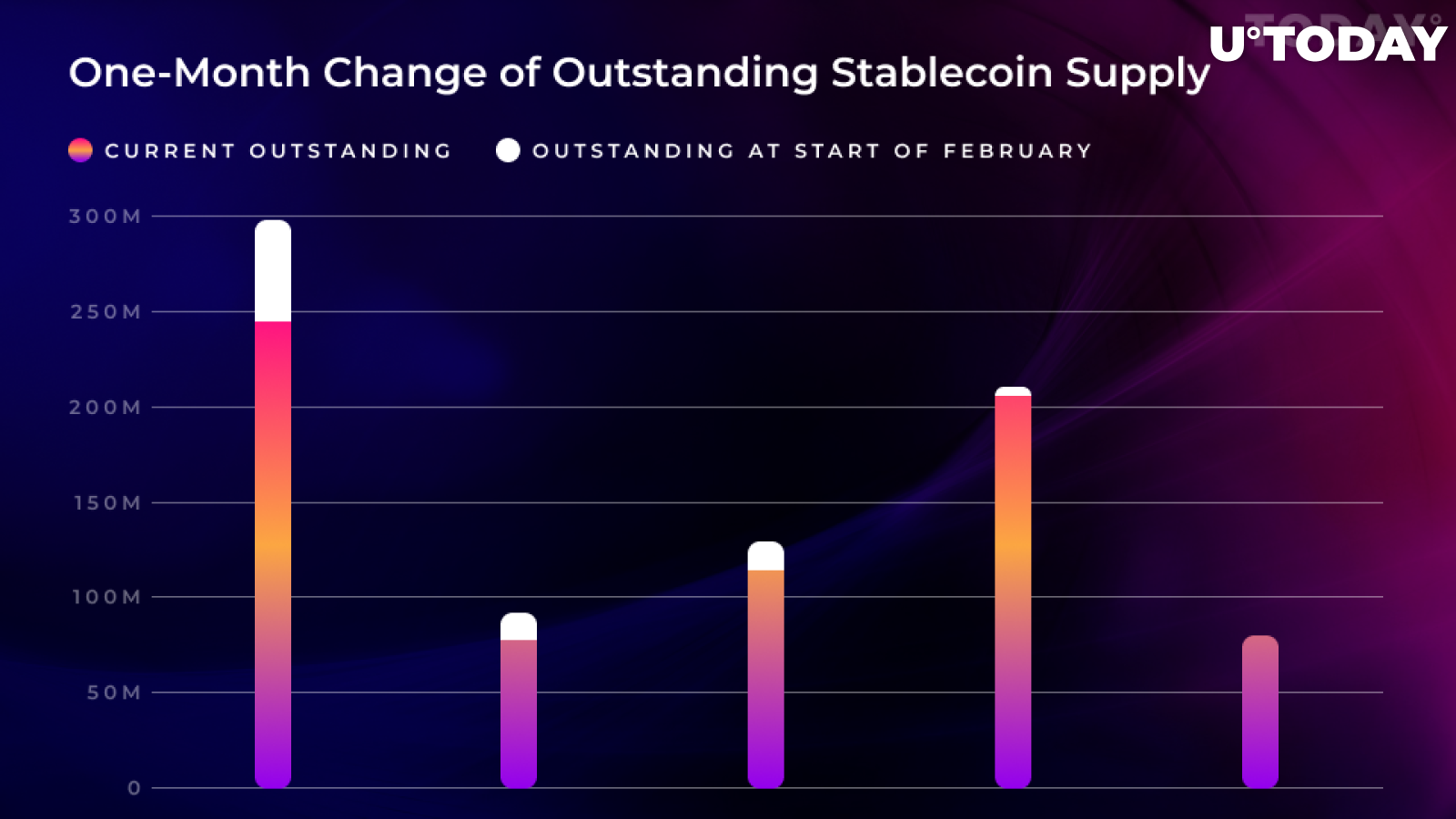

Stablecoins were one of the biggest crypto trends of 2018, but a recently published Diar study shows that might not be the case this year. USD Coin (USDC), Gemini Dollar (GUSD), Paxos Standard (PAX), and TrueUSD (TUSD) all saw their outstanding supply decreasing this February.

The stablecoin market hits a snag

Overall, the aforementioned cryptocurrencies had a 10 percent net decrease in market capitalization. USD Coin (USDC) is the biggest stablecoin from the pack, currently occupying 23rd place on CMC with a market cap of $247 mln. The circulating supply of Circle’s coin was standing at almost $300 mln at the beginning of February, but now it’s at $244 mln.

card

Nevertheless, the stablecoin ecosystem is getting even more crowded with JPMorgan recently launching JPM Coin, a new dollar-pegged cryptocurrency.

Tether remains unbothered

Notably, the circulating supply of Tether (USDT), the flagship stablecoin, remains practically unchanged. USDT, despite its numerous controversies, was recently praised by Michael Gronager, the CEO of Chainalysis. Dai (DAI), an Ethereum-collateralized cryptocurrency, also didn’t experience supply reduction.