The analytics data provider Skew may have found the reason for the sudden Bitcoin price reverse that made it go back under $10,000 – XBT/USD traders on BitMEX.

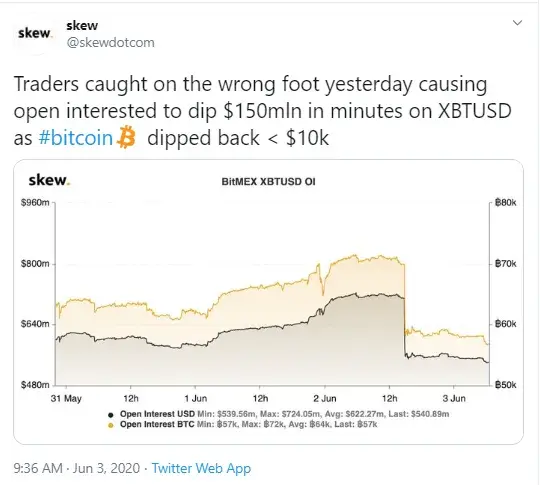

Bitcoin open interest is down $150 mln on BitMEX

The analytics agency Skew has shared a chart that shows that thanks to traders’ actions on BitMEX on June 2, the open interest on the XBT/USD pair lost $150 mln within minutes.

This coincided with the Bitcoin price drop back below $10,000.

Open interest on Bitcoin-based contracts is the overall amount of contracts held by traders. In the case of BitMEX, XBT is a perpetual contract on BTC.

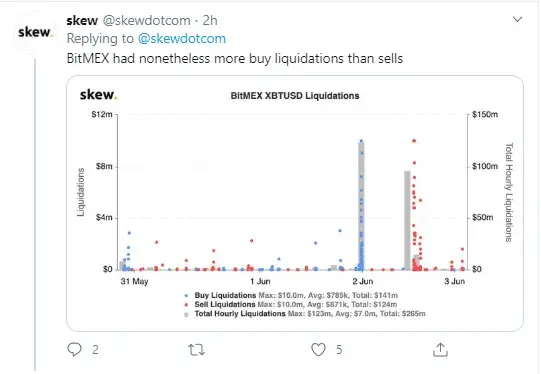

BitMEX shows more buy liquidations than OKEx

However, Skew also tweets that despite the loss in the open interest on the XBT perpetual contracts, BitMEX still shows a larger amount of buy liquidations than sell ones.

Buy liquidations imply a forced reversal of short positions, whereas sell liquidations mean that long positions of traders were unwound.

Earlier, Skew reported that the recent jump of the Bitcoin price above the $10,000 level may have happened due to over $100 mln worth of buy liquidations on BitMEX.

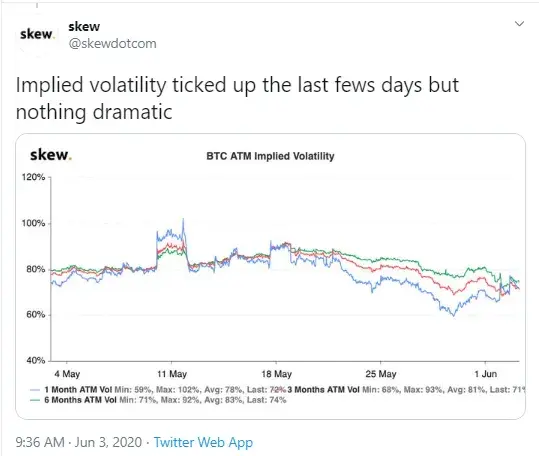

Implied volatility rises but not dramatically

As for another crypto exchange, OKEx, Skew says that on this venue the situation with the buy/sell liquidations is different from BitMEX. As per the chart shared, on OKEx there are many more sell liquidations, which means that a lot of long BTC positions got reversed.

Overall, Skew stated that Bitcoin implied volatility has surged a little but there is ‘nothing dramatic’ about it.

Changes in implied BTC volatility are neither bullish nor bearish signs. They manifest possible changes in premiums traders pay on BTC options.

Higher volatility implies that traders are getting alerted and making sure all their stop-loss orders are placed.

Besides, since premiums on options rise in this case, leveraged trading will require a substantial part of their margin.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov